Mathematics, 20.09.2019 08:30 rubycarbajal

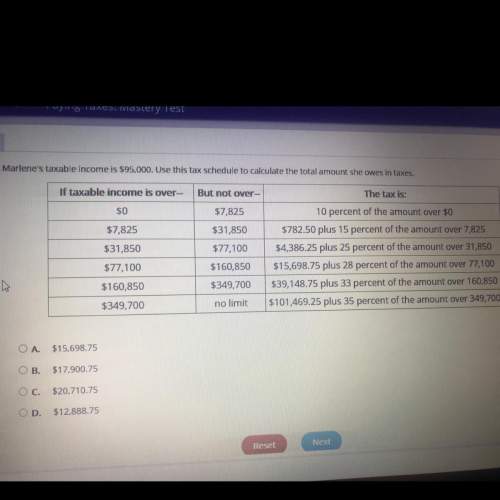

Marlene's taxable income is $95.000. use this tax schedule to calculate the total amount she owes in taxes.

if taxable income is over-

but not over-

the tax is:

$0

$7,825

$7,825

$31,850

10 percent of the amount over $0

$782.50 plus 15 percent of the amount over 7,825

$4,386.25 plus 25 percent of the amount over 31,850

$15,698.75 plus 28 percent of the amount over 77,100

$39,148.75 plus 33 percent of the amount over 160,850

$101,469.25 plus 35 percent of the amount over 349,700

$31,850

$77,100

$160,850

$349,700

no limit

$77,100

$160,850

$349,700

o a

$15,698.75

b.

$17,900.75

oc. $20,710.75

d. $12,888.75

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 17:00

Somone me i want to know what 18 hours out of 24 hours in a fraction

Answers: 1

Mathematics, 21.06.2019 19:00

The annual snowfall in a town has a mean of 38 inches and a standard deviation of 10 inches. last year there were 63 inches of snow. find the number of standard deviations from the mean that is, rounded to two decimal places. 0.44 standard deviations below the mean 2.50 standard deviations below the mean 0.44 standard deviations above the mean 2.50 standard deviations above the mean

Answers: 3

Mathematics, 21.06.2019 22:30

Which answer goes into the box? (90° clockwise rotation, 90° counter clockwise rotation, translation, or glide reflection)

Answers: 2

You know the right answer?

Marlene's taxable income is $95.000. use this tax schedule to calculate the total amount she owes in...

Questions

History, 13.02.2021 07:40

Mathematics, 13.02.2021 07:40

Spanish, 13.02.2021 07:40

Mathematics, 13.02.2021 07:40

Mathematics, 13.02.2021 07:40

Mathematics, 13.02.2021 07:40