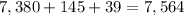

Annual rent $ 7,380

insurance 145

security deposit 650

annual mortgage payments $9...

Mathematics, 20.09.2019 20:10 gmedisa08

Annual rent $ 7,380

insurance 145

security deposit 650

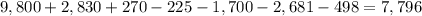

annual mortgage payments $9,800 ($9,575 is interest)

property taxes 1,780

insurance/maintenance 1,050

down payment/closing costs 4,500 growth in equity 225

estimated annual appreciation 1,700

assume an after-tax savings interest rate of 6 percent and a tax rate of 28 percent.

a) calculate the total rental cost and total buying cost. (round your intermediate calculations and final answers to the nearest whole number.)

b) would you recommend buying or renting?

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 17:40

Afamily of five rents a kayak and splits the total time, k, equally. each family member spent less than 25 minutes kayaking. which values can be used to complete the math sentence below so that it accurately represents the situation? intro done

Answers: 2

Mathematics, 21.06.2019 20:00

Graph the linear function using the slooe and y intercept

Answers: 2

Mathematics, 21.06.2019 21:30

50 plz, given the system of equations, match the following items. x + 3 y = 5 x - 3 y = -1 a) x-determinant b) y-determinant c) system determinant match the following to the pictures below.

Answers: 2

Mathematics, 21.06.2019 23:30

Solve the following: 12(x^2–x–1)+13(x^2–x–1)=25(x^2–x–1) 364x–64x=300x

Answers: 1

You know the right answer?

Questions

Mathematics, 12.01.2021 23:20

Physics, 12.01.2021 23:20

Mathematics, 12.01.2021 23:20

Spanish, 12.01.2021 23:20

Mathematics, 12.01.2021 23:20

Mathematics, 12.01.2021 23:20

Chemistry, 12.01.2021 23:20

History, 12.01.2021 23:20

History, 12.01.2021 23:20

Mathematics, 12.01.2021 23:20

Business, 12.01.2021 23:20

Mathematics, 12.01.2021 23:20

Mathematics, 12.01.2021 23:20

= $2830

= $2830 dollars

dollars dollars

dollars