Mathematics, 09.10.2019 02:30 gabriellabadon2

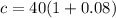

The tax rate as a percent, r, charged on an item can be determined using the formula startfraction c over p endfraction minus 1 equals r. – 1 = r, where c is the final cost of the item and p is the price of the item before tax. louise rewrites the equation to solve for the final cost of the item: c = p(1 + ). what is the final cost of a $40 item after an 8% tax is applied?

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 21:00

What is the similarity ratio of a cube with volume 729m^3 to a cube with volume 3375 m^3

Answers: 2

Mathematics, 22.06.2019 05:40

What is the inter-quartile range of the given data set? 2 3 6

Answers: 1

Mathematics, 22.06.2019 06:50

What is the equation of a line, in general form, that passes through point (1, -2) and has a slope of 1/3 3x - y - 7 = 0 x - 3y + 7 = 0 x - 3y - 7 = 0

Answers: 1

You know the right answer?

The tax rate as a percent, r, charged on an item can be determined using the formula startfraction c...

Questions

Chemistry, 26.04.2021 21:00

History, 26.04.2021 21:00

Mathematics, 26.04.2021 21:00

History, 26.04.2021 21:00

Mathematics, 26.04.2021 21:00

Mathematics, 26.04.2021 21:00

Mathematics, 26.04.2021 21:00

English, 26.04.2021 21:00

English, 26.04.2021 21:00