Mathematics, 24.10.2019 02:50 dominikbatt

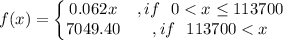

If you earned up to $113,700 in 2013 from an employer, your social security tax rate was 6.2% of your income. if

you earned over $113,700, you paid a fixed amount of $7,049.40.

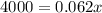

c. how much money would you have made if you paid $4,000 in social security tax in 2013?

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 18:00

Each month, a shopkeeper spends 5x + 14 dollars on rent and electricity. if he spends 3x−5 dollars on rent, how much does he spend on electricity? for which value(s) of x is the amount the shopkeeper spends on electricity less than $100? explain how you found the value(s).

Answers: 2

Mathematics, 21.06.2019 18:30

The formula for the lateral area of a right cone is la = rs, where r is the radius of the base and s is the slant height of the cone.which are equivalent equations?

Answers: 3

Mathematics, 22.06.2019 00:00

Darragh has a golden eagle coin in his collection with a mass of 13.551\,\text{g}13.551g. an uncirculated golden eagle coin has a mass of 13.714\,\text{g}13.714g.

Answers: 2

You know the right answer?

If you earned up to $113,700 in 2013 from an employer, your social security tax rate was 6.2% of you...

Questions

Physics, 12.08.2020 09:01

Mathematics, 12.08.2020 09:01

Chemistry, 12.08.2020 09:01

Health, 12.08.2020 09:01

History, 12.08.2020 09:01

Mathematics, 12.08.2020 09:01

Mathematics, 12.08.2020 09:01

History, 12.08.2020 09:01

Mathematics, 12.08.2020 09:01

Mathematics, 12.08.2020 09:01

Mathematics, 12.08.2020 09:01

Spanish, 12.08.2020 09:01

Mathematics, 12.08.2020 09:01

$64516.13

$64516.13