Mathematics, 26.11.2019 19:31 ShilohTheBoy

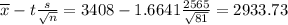

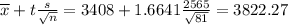

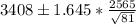

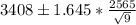

In a random sample of 81 audited estate tax returns, it was determined that the mean amount of additional tax owed was $3408 with a standard deviation of $2565. construct and interpret a 90% confidence interval for the mean additional amount of tax owed for estate tax returns. the lower bound is $ nothing. (round to the nearest cent as needed.) the upper bound is $ nothing. (round to the nearest cent as needed.) interpret a 90% confidence interval for the mean additional amount of tax owed for estate tax returns. choose the correct answer below.

a. one can be 90% confident that the mean additional tax owed is less than the lower bound

b. one can be 90% confident that the mean additional tax owed is between the lower and upper bounds

c. one can be 90% confident that the mean additional tax owed is greater than the upper bound.

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 17:30

Astudent survey asked: "how tall are you (in inches)? " here's the data: 67, 72, 73, 60, 65, 86, 72, 69, 74 give the five number summary. a. median: 73, mean: 70.89, iqr: 5, min: 60, max: 74 b. 60, 66, 72, 73.5, 86 c. 60, 67, 72, 73, 74 d. 0, 60, 70, 89, 74, 100

Answers: 3

Mathematics, 21.06.2019 19:30

Ineed with angles and the measure of them i have abc a is 65 and b is (3x-10) and c is (2x) find the value of x

Answers: 2

You know the right answer?

In a random sample of 81 audited estate tax returns, it was determined that the mean amount of addit...

Questions

SAT, 14.05.2020 10:57

Mathematics, 14.05.2020 10:57

Mathematics, 14.05.2020 10:57

Chemistry, 14.05.2020 10:57

History, 14.05.2020 10:57

English, 14.05.2020 11:56

Mathematics, 14.05.2020 11:57

Health, 14.05.2020 11:57

Mathematics, 14.05.2020 11:57

Mathematics, 14.05.2020 11:57

.

.

.

.

.

.