Mathematics, 28.11.2019 04:31 carolyntowerskemp

An investor with $10,000 available to invest has the following options: (1) he can invest in a risk-free savings account with a guaranteed 3% annual rate of return; (2) he can invest in a fairly safe stock, where the possible annual rates of return are 6%, 8%, or 10%; or (3) he can invest in a more risky stock, where the possible annual rates of return are 1%, 9%, or 17%. the investor can place all of his available funds in any one of these options, or he can split his $10,000 into two $5000 investments in any two of these options. the joint probability distribution of the possible return rates for the two stocks is given in the file p09_34.xlsx.

a. use precisiontree to identify the strategy that maximizes the investor’s expected one-year earnings.

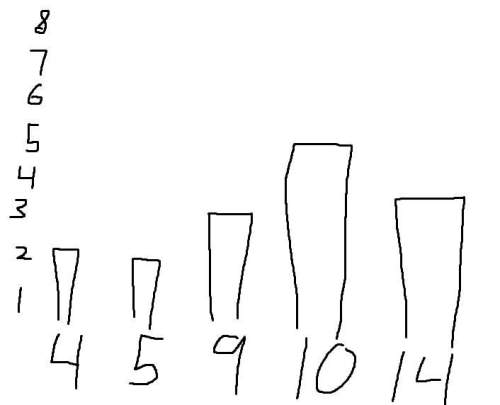

b. perform a sensitivity analysis on the optimal decision, letting the amount available to invest and the risk-free return both vary, one at a time, plus or minus 100% from their base values, and summarize your findings.

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 14:00

Ms. sutton recorded the word counts and scores of the top ten essays in a timed writing contest. the table shows her data. how does the word count of an essay relate to its score in the contest? word count tends to decrease as the score decreases. word count tends to increase as the score decreases. word count tends to remain constant as the score decreases. word count has no apparent relationship to the score of the essay.

Answers: 1

Mathematics, 21.06.2019 17:30

Find the zero function by factoring (try to show work) h(x)=-x^2-6x-9

Answers: 2

Mathematics, 21.06.2019 22:30

Using the figure below, select the two pairs of alternate interior angles.a: point 1 and point 4 b : point 2 and point 3 c: point 6 and point 6d: point 5 and point 7

Answers: 2

Mathematics, 21.06.2019 23:00

In january 2010, you began a one-year study of tuberculosis (tb) in a subsidized housing community in the lower east side of new york city. you enrolled 500 residents in your study and checked on their tb status on a monthly basis. at the start of your study on january 1st, you screened all 500 residents. upon screening, you found that 30 of the healthy residents had been vaccinated for tb and therefore were not at risk. another 20 residents already had existing cases of tb on january 1st. on february 1st, 5 residents developed tb. on april 1st, 10 more residents developed tb. on june 1st, 10 healthy residents moved away from new york city and were lost to follow-up. on july 1st, 10 of the residents who had existing tb on january 1st died from their disease. the study ended on december 31, 2010. assume that once a person gets tb, they have it for the duration of the study, and assume that all remaining residents stayed healthy and were not lost to follow-up. is the subsidized housing community in the lower east side of new york city a dynamic or fixed population? briefly explain the rationale for your answer. dynamic population it can changeable people can move out and move in into the population of a subsidized housing what was the prevalence of tb in the screened community on january 1st? prevalence = 30/500 0.06= 6% what was the prevalence of tb on june 30th? prevalence= 40/450=0.08= 8.88% what was the cumulative incidence of tb over the year? cumulative incidence = number of new cases/number in candidate population)over specified time period 10/450 = 2.2% suppose that you wanted to calculate the incidence rate of tb in the study population. calculate the amount of person-time that would go in the denominator of this incidence rate. be sure to show your work.

Answers: 2

You know the right answer?

An investor with $10,000 available to invest has the following options: (1) he can invest in a risk...

Questions

Mathematics, 18.11.2020 23:50

Mathematics, 18.11.2020 23:50

Mathematics, 18.11.2020 23:50

Chemistry, 18.11.2020 23:50

Business, 18.11.2020 23:50

Law, 18.11.2020 23:50

Mathematics, 18.11.2020 23:50

Advanced Placement (AP), 18.11.2020 23:50

Mathematics, 18.11.2020 23:50

Mathematics, 18.11.2020 23:50

Chemistry, 18.11.2020 23:50

Mathematics, 18.11.2020 23:50

Mathematics, 18.11.2020 23:50

Mathematics, 18.11.2020 23:50

Mathematics, 18.11.2020 23:50

Arts, 18.11.2020 23:50