Mathematics, 29.11.2019 01:31 lilly420

Acompany with a june 30 fiscal year end entered into a $3,000,000 construction project on april 1 to be completed on september 30. the cumulative construction-in-progress balances at april 30, may 31, and june 30 were $500,000, $800,000, and $1,500,000, respectively. the interest rate on company debt used to finance the construction project was 5% from april 1 through june 30 and 6% from july 1 through september 30. assuming that the asset is placed into service on october 1, what amount of interest should be capitalized to the project on june 30?

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 22:30

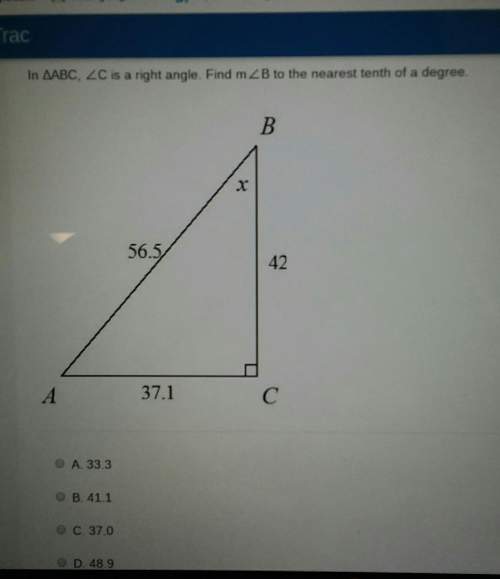

I’m really confused and need your assist me with this question i’ve never been taught

Answers: 1

Mathematics, 22.06.2019 01:30

What rule describes a dilation with a scale factor of 4 and the center of dilation at the origin?

Answers: 1

Mathematics, 22.06.2019 04:20

The weibull distribution is widely used in statistical problems relating to aging of solid insulating materials subjected to aging and stress. use this distribution as a model for time (in hours) to failure of solid insulating specimens subjected to ac voltage. the values of the parameters depend on the voltage and temperature; suppose α = 2.5 and β = 190. (a) what is the probability that a specimen's lifetime is at most 250? less than 250? more than 300? (round your answers to four decimal places.) at most 250 less than 250 more than 300 (b) what is the probability that a specimen's lifetime is between 100 and 250? (round your answer to four decimal places.) (c) what value is such that exactly 50% of all specimens have lifetimes exceeding that value? (round your answer to three decimal places.) hr

Answers: 2

Mathematics, 22.06.2019 05:30

Robert plans to make a box-and-whisker plot of the following set of data. 27, 14, 46, 38, 32, 18, 21 which of the following should robert's box-and-whisker plot look like?

Answers: 1

You know the right answer?

Acompany with a june 30 fiscal year end entered into a $3,000,000 construction project on april 1 to...

Questions