Mathematics, 24.12.2019 18:31 ashleyd198308

The current value of a property is $140,000. the property is assessed at 40 percent of its current value, with an equalization factor of 1.5 applied to the assessed value. if the tax rate is $4 per $100 of assessed value, what is the amount of tax due on the property? a. $840b. $3,360c. $5,600d. $8,400

Answers: 3

Another question on Mathematics

Mathematics, 22.06.2019 03:30

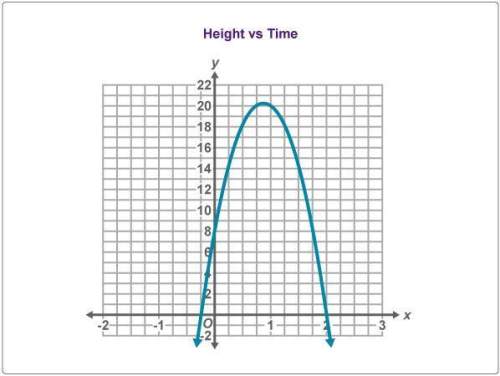

*15 pts* the graph of an exponential function of the form y = f(x) = ax passes through the points and the graph lies the x-axis. first line choices: (0, a) (0, 1) (0, 2) (0, -1) second line choices: (1, 0) (1, a) (1, 1) (1, -2) third line choices: above below on the

Answers: 1

Mathematics, 22.06.2019 05:30

Brainliest find the value of a^n b^n if n=3,a=100,and b=1/4

Answers: 2

Mathematics, 22.06.2019 05:30

Graph the linear equation. find threepoints that solve the equation, then ploton the graph.-x-3y=-6

Answers: 2

Mathematics, 22.06.2019 06:00

Ndicate in standard form the equation of the line through the given points. p(0, -4), q(5, 1)

Answers: 2

You know the right answer?

The current value of a property is $140,000. the property is assessed at 40 percent of its current v...

Questions

History, 20.10.2020 18:01

Mathematics, 20.10.2020 18:01

History, 20.10.2020 18:01

Mathematics, 20.10.2020 18:01

Mathematics, 20.10.2020 18:01

Social Studies, 20.10.2020 18:01

English, 20.10.2020 18:01

Mathematics, 20.10.2020 18:01