Carol uses this graduated tax schedule to determine how much income tax she owes.

if taxable i...

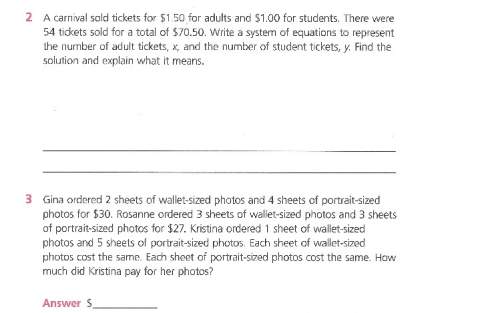

Mathematics, 21.01.2020 19:31 ambriyaarmstrong01

Carol uses this graduated tax schedule to determine how much income tax she owes.

if taxable income is over. but not over-

the tax is:

$0

$7,825 10% of the amount over so

$7,825

$31,850 $782.50 plus 15% of the amount over 7,825

$31.850

$4,386 25 plus 25% of the amount over 31,850

$64,250

$97.925

$12,486.25 plus 28% of the amount over

64.250

$97.925

5174,850

$21.915.25 plus 33% of the amount over

97,925

$174,850

$47,300.50 plus 35% of the amount over

no limit

174,850

if carol's taxable income is $89,786, how much income tax does she owe, to the nearest dollar?

a $25,140

b. $12,654

c $19,636

d. $37,626

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 17:30

The graph below represents the number of dolphins in a dolphin sanctuary. select all the key features of this function.

Answers: 2

Mathematics, 21.06.2019 23:00

Jane’s favorite fruit punch consists of pear, pineapple, and plum juices in the ratio 5: 2: 3. how many cups of pear juice should she use to make 20 cups of punch?

Answers: 1

Mathematics, 22.06.2019 01:30

Jacob is graphing the line represented by the equation −6x−5y=12.−6x−5y=12. he first plots the x-x- and y-interceptsy-intercepts as follows. which statement is correct regarding the intercepts on the graph?

Answers: 1

Mathematics, 22.06.2019 03:30

Identify the number as a regional or irrational.explain. 291.87

Answers: 1

You know the right answer?

Questions

Mathematics, 02.02.2021 23:10

Mathematics, 02.02.2021 23:10

Physics, 02.02.2021 23:10

Mathematics, 02.02.2021 23:10