Mathematics, 12.02.2020 00:54 YoungLarQ

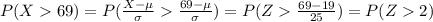

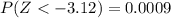

The historical returns on a portfolio had an average return of 19 percent and a standard deviation of 25 percent. Assume that returns on this portfolio follow a bell-shaped distribution. a. Approximately what percentage of returns were greater than 69 percent?b. Approximately what percentage of returns were below –56 percent?

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 23:00

Joey is asked to name a quadrilateral that is also a rhombus and has 2 pairs of parallel sides.should be his answer

Answers: 1

Mathematics, 21.06.2019 23:40

Will give brainliest b. describe the function over each part of its domain. state whether it is constant, increasing, or decreasing, and state the slope over each part.

Answers: 1

Mathematics, 22.06.2019 00:30

If we pull out the middle player of team a and the fourth player of the team b. what will be the force of team a and team b? what is their sum of forces

Answers: 2

Mathematics, 22.06.2019 02:30

Fred and gene are hang gliding. fred is 700 feet above the ground and descending at 15 ft/s. gene is decending as shown in the table. interpret the rates of change and initial values of the linear functions in terms of the situations they model. show all work. freds equation is f(x)=-15x+700. ( genes is the table attached)

Answers: 1

You know the right answer?

The historical returns on a portfolio had an average return of 19 percent and a standard deviation o...

Questions

Chemistry, 16.10.2020 08:01

Mathematics, 16.10.2020 08:01

Mathematics, 16.10.2020 08:01

Mathematics, 16.10.2020 08:01

Biology, 16.10.2020 08:01

and

and