Mathematics, 24.02.2020 23:13 wyattjefferds05

Suppose two portfolios have the same average return, the same beta, but portfolio A has a lower standard deviation of returns than portfolio B. According to the Sharpe ratio, the performance of portfolio A . a. is better than the performance of portfolio B b. is the same as the performance of portfolio B c. is poorer than the performance of portfolio B d. cannot be measured as there is no data on the alpha of the portfolio e. None of these is correct.

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 17:30

Can someone me and do the problem plz so i can understand it more better

Answers: 2

Mathematics, 21.06.2019 19:30

Plz.yesterday, the snow was 2 feet deep in front of archie’s house. today, the snow depth dropped to 1.6 feet because the day is so warm. what is the percent change in the depth of the snow?

Answers: 1

Mathematics, 22.06.2019 04:30

Marcy is conducting a study regarding the amount of time students at her school spend talking to friends online. which group would give marcy the best results for her study?

Answers: 3

Mathematics, 22.06.2019 05:30

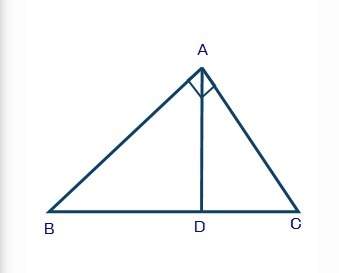

In the figure, ab = 14 inches, ac= 16 inches,ay=9 inches, and bz = 10 inches find the area of the triangle abc. answer quick

Answers: 2

You know the right answer?

Suppose two portfolios have the same average return, the same beta, but portfolio A has a lower stan...

Questions

Arts, 18.12.2020 01:00

Mathematics, 18.12.2020 01:00

Mathematics, 18.12.2020 01:00

Mathematics, 18.12.2020 01:00

Biology, 18.12.2020 01:00

English, 18.12.2020 01:00

Mathematics, 18.12.2020 01:00

Arts, 18.12.2020 01:00

Mathematics, 18.12.2020 01:00

English, 18.12.2020 01:00

History, 18.12.2020 01:00