Mathematics, 28.02.2020 20:16 julielebo8

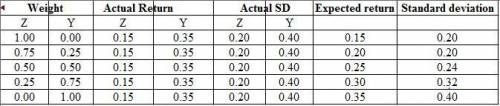

The expected returns and standard deviation of returns for two securities are as follows: Security Z Security Y Expected Return 15% 35% Standard Deviation 20% 40% The correlation between the returns is .25. (a) Calculate the expected return and standard deviation for the following portfolios: i. all in Z ii. .75 in Z and .25 in Y iii. .5 in Z and .5 in Y iv. .25 in Z and .75 in Y

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 18:30

Given the equation f(x)=a(b)x where the initial value is 40 and the growth rate is 20% what is f(4)

Answers: 1

Mathematics, 21.06.2019 23:00

Which of the following scenarios demonstrates an exponential decay

Answers: 1

Mathematics, 22.06.2019 03:00

Pranav and molly are selling pies for a school fundraiser. customers can buy blueberry pies and pumpkin pies. pranav sold 6 blueberry pies and 4 pumpkin pies for a total of $106. molly sold 6 blueberry pies and 3 pumpkin pies for a total of $90. find the cost of each of one blueberry pie and one pumpkin pie

Answers: 2

You know the right answer?

The expected returns and standard deviation of returns for two securities are as follows: Security Z...

Questions

Mathematics, 04.06.2020 14:57

Mathematics, 04.06.2020 14:57

Mathematics, 04.06.2020 14:57

Mathematics, 04.06.2020 14:57

![E (return) = [W(Z)\times E(Z)]+[W(Y)\times E(Y)]](/tpl/images/0528/3761/aa45c.png)