Mathematics, 28.02.2020 23:28 oreoassassin38

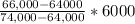

Karen, 28 years old and a single taxpayer, has a salary of $33,000 and rental income of $33,000 for the 2019 calendar tax year. Karen is covered by a pension through her employer. AGI phase-out range for traditional IRA contributions for a single taxpayer who is an active plan participant is $64,000 – $74,000. a. What is the maximum amount that Karen may deduct for contributions to her traditional IRA for 2019?

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 20:30

Find the area of the triangle formed by the origin and the points of intersection of parabolas y=−3x^2+20 and y=x^2−16.

Answers: 3

Mathematics, 21.06.2019 21:30

Three friends went on a road trip from phoenix, az, to san diego, ca. mark drove 50 percent of the distance. jason drove 1/8 of the distance. andy drove the remainder of the distance. 1. andy thinks he drove 1/4 of the distance from phoenix, az, to san diego, ca. is andy correct? 2. the distance from phoenix, az, to san diego, ca, is 360 miles. how many miles did each person drive? 3. solve the problem. what is the answer in total?

Answers: 3

Mathematics, 22.06.2019 06:10

Use the given information to determine the exact trig value. cot theta = -square root of 5 / 2 , pi/2 < theta < pi, tan theta a.) - square root of 5 / 5 c.) - 2 square root of 5 / 5 b.) - square root of 5 / 2 d.) the answer isn't d, it was incorrect

Answers: 2

Mathematics, 22.06.2019 06:40

Which is the directrix of a parabola with equation x2=8y y = 2 x= -2 y=-2 x= 2

Answers: 1

You know the right answer?

Karen, 28 years old and a single taxpayer, has a salary of $33,000 and rental income of $33,000 for...

Questions

Mathematics, 28.08.2019 17:30

History, 28.08.2019 17:30

Mathematics, 28.08.2019 17:30

Computers and Technology, 28.08.2019 17:30

Biology, 28.08.2019 17:30

English, 28.08.2019 17:30

Physics, 28.08.2019 17:30

Mathematics, 28.08.2019 17:30

Chemistry, 28.08.2019 17:30

Mathematics, 28.08.2019 17:30

Chemistry, 28.08.2019 17:30

Geography, 28.08.2019 17:30