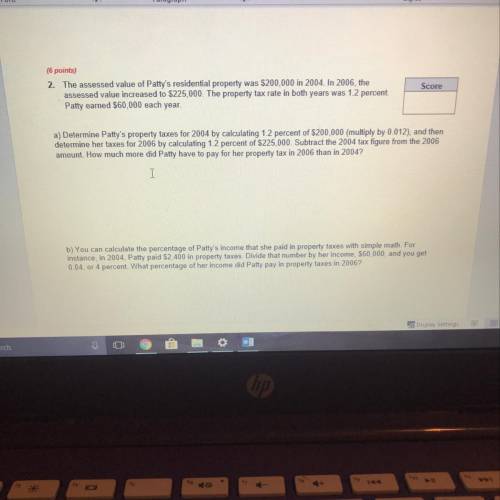

The assessed value of Patty's residential property was $200,000 in 2004. In 2006, the

assessed...

Mathematics, 02.03.2020 05:34 ziar7176

The assessed value of Patty's residential property was $200,000 in 2004. In 2006, the

assessed value increased to $225,000. The property tax rate in both years was 1.2 percent.

Patty earned $60,000 each year.

a) Determine Patty's property taxes for 2004 by calculating 1.2 percent of $200,000 (multiply by 0.012), an

determine her taxes for 2006 by calculating 1.2 percent of $225,000. Subtract the 2004 tax figure from the

amount. How much more did Patty have to pay for her property tax in 2006 than in 2004?

b) You can calculate the percentage of Patty's income that she paid in property taxes with simple math. For

instance, in 2004, Patty paid $2,400 in property taxes. Divide that number by her income, $60,000, and you

0.04. or 4 percent. What percentage of her income did Patty pay in property taxes in 2006?

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 18:00

Place the following steps in order to complete the square and solve the quadratic equation,

Answers: 1

Mathematics, 21.06.2019 21:10

Mackenzie needs to determine whether the rectangles are proportional. which process could she use? check all that apply.

Answers: 1

Mathematics, 21.06.2019 23:30

Consider the input and output values for f(x) = 2x - 3 and g(x) = 2x + 7. what is a reasonable explanation for different rules with different input values producing the same sequence?

Answers: 1

You know the right answer?

Questions

Mathematics, 19.04.2020 00:59

Mathematics, 19.04.2020 00:59

English, 19.04.2020 00:59

Mathematics, 19.04.2020 00:59

Mathematics, 19.04.2020 00:59

Mathematics, 19.04.2020 01:00

History, 19.04.2020 01:00

Mathematics, 19.04.2020 01:00

Mathematics, 19.04.2020 01:00