Mathematics, 06.03.2020 05:54 g0606997

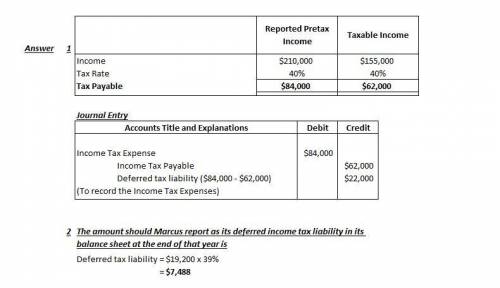

For its first year of operations, Marcus Corporation reported pretax accounting income of $274,800. However, because of a temporary difference in the amount of $19,200 relating to depreciation, taxable income is only $255,600. The tax rate is 39%. What amount should Marcus report as its deferred income tax liability in its balance sheet at the end of that year

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 19:30

Plz.yesterday, the snow was 2 feet deep in front of archie’s house. today, the snow depth dropped to 1.6 feet because the day is so warm. what is the percent change in the depth of the snow?

Answers: 1

Mathematics, 21.06.2019 22:00

Students at a high school were asked about their favorite outdoor activity. the results are shown in the two-way frequency table below. fishing camping canoeing skiing total boys 36 44 13 25 118 girls 34 37 22 20 113 total 70 81 35 45 231 select all the statements that are true based on the given table. more girls chose camping as their favorite outdoor activity than boys. more girls chose canoeing as their favorite outdoor activity than those who chose skiing. more boys chose skiing as their favorite outdoor activity than girls. there were more boys surveyed than girls. twice as many students chose canoeing as their favorite outdoor activity than those who chose fishing. more students chose camping as their favorite outdoor activity than the combined number of students who chose canoeing or skiing.

Answers: 1

Mathematics, 21.06.2019 23:10

Aline has a slope of . which ordered pairs could be points on a parallel line? check all that apply. (-8, 8) and (2, 2) (-5, -1) and (0, 2) (-3, 6) and (6, -9) (-2, 1) and (3,-2) (0, 2) and (5,5)

Answers: 3

Mathematics, 22.06.2019 00:00

Last week jason walked 3 1/4 miles each day for 3 days and 4 5/8 miles each day for 4 days. about how many miles did jason walk last week?

Answers: 1

You know the right answer?

For its first year of operations, Marcus Corporation reported pretax accounting income of $274,800....

Questions

Mathematics, 25.04.2021 19:30

Social Studies, 25.04.2021 19:30

Mathematics, 25.04.2021 19:40

Mathematics, 25.04.2021 19:40

Physics, 25.04.2021 19:40

Advanced Placement (AP), 25.04.2021 19:40

Chemistry, 25.04.2021 19:40

Mathematics, 25.04.2021 19:40

Mathematics, 25.04.2021 19:40

Mathematics, 25.04.2021 19:40

History, 25.04.2021 19:40