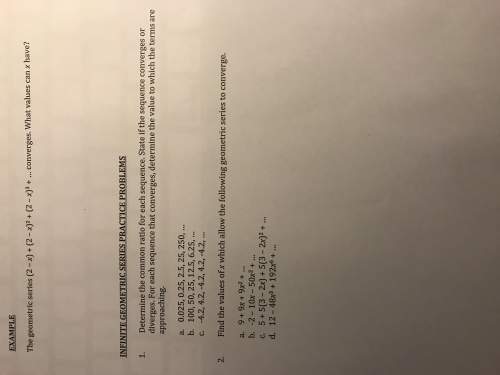

geometric series converge the common ratio r has magnitude less than one.

which is equivalent to

for the example we need

|2-x| < 1

-1 < 2-x and 2-x < 1

x < 3 and x > 1

we can write that

answer: 1 < x < 3

1a. common ratio r=250/25=10 > 1 diverges

1b. r=50/100=1/2 converges

when these converge they converge to

where a is the first term.

answer: 200

1c. r=-1 so it's not the case that |r| < 1. diverges

2a. x is the common ratio so we converge when |x|< 1

2b. r=-10x / -2 = 5x.

we converge when

|5x| < 1

|x| < 1/5

2c. r=3-2x

-1 < 3-2x and 3-2x < 1

-4 < -2x and 2 < 2x

x < 2 and 1 < x

1 < x < 2

2d. [/tex] r=-48x^3/12 = 4x^3[/tex]

|4x^3| < 1

|x^3| < \frac 1 4

|x| < 4^{-1/3}

![|x| < \frac 1 2 \sqrt[3]{2}](/tex.php?f= |x| < \frac 1 2 \sqrt[3]{2})