Mathematics, 12.03.2020 06:59 trintrin227

Larry is considering taking out a loan. He estimates that he can afford monthly payments of $265 for 10 years in order to support his loan. He finds that, with an APR of 5.5% compounded monthly, he can take a loan of $24,418.05.

Assuming that Larry's monthly payment and the length of the loan remain fixed, which of these statements is true about the size of the loan Larry could take if he received a different APR?

A. If the interest rate were 6.6%, the amount of the loan that Larry is considering taking out would be more than $24,418.05.

B. If the interest rate were 6.2%, the amount of the loan that Larry is considering taking out would be more than $24,418.05.

C. If the interest rate were 5.2%, the amount of the loan that Larry is considering taking out would be less than $24,418.05.

D. If the interest rate were 5.8%, the amount of the loan that Larry is considering taking out would be less than $24,418.05.

Answers: 3

Another question on Mathematics

Mathematics, 20.06.2019 18:04

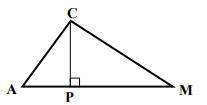

Using d, e, and f as values on a triangle and d being 60 degrees, what is the value of e and f if d is 60 degrees? also, what do you notice about the values of e and f?

Answers: 1

Mathematics, 21.06.2019 15:30

What number should be added to both sides of the equation to complete this square? x^2-10x=7

Answers: 3

Mathematics, 21.06.2019 20:30

Ateam has p points. p = 3w + d w = wins d = draws a) a football team has 5 wins and 3 draws. how many points does the team have?

Answers: 1

You know the right answer?

Larry is considering taking out a loan. He estimates that he can afford monthly payments of $265 for...

Questions

Chemistry, 28.09.2019 05:30

World Languages, 28.09.2019 05:30

History, 28.09.2019 05:30

Mathematics, 28.09.2019 05:30

Biology, 28.09.2019 05:30

History, 28.09.2019 05:30

English, 28.09.2019 05:30

Mathematics, 28.09.2019 05:30

Social Studies, 28.09.2019 05:30

English, 28.09.2019 05:30