1. HBM, Inc. has the following capital st

s the following capital structure:

Assets

$...

Mathematics, 01.04.2020 05:42 NewKidnewlessons

1. HBM, Inc. has the following capital st

s the following capital structure:

Assets

$400,000

Debt

Preferred stock

Common stock

$140,000

20,000

240,000

The common stock is currently se

mon stock is currently selling for $15 a share, pays a cash dividend of

per share, and is growing annually at 6 percent. The preferred stock pays

y cash dividend and currently sells for $91 a share. The debt pays interest of

0.5 percent annually, and the firm is in the 30 percent marginal tax bracket.

a. What is the after-tax cost of debt?

b. What is the cost of preferred stock?

c. What is the cost of common stock?

d. What is the firm's weighted average cost of capital?

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 22:00

How do you write a paragraph proof to prove that the corresponding angles shown are congruent

Answers: 2

Mathematics, 21.06.2019 23:00

Jane’s favorite fruit punch consists of pear, pineapple, and plum juices in the ratio 5: 2: 3. how many cups of pear juice should she use to make 20 cups of punch?

Answers: 1

You know the right answer?

Questions

History, 10.10.2020 14:01

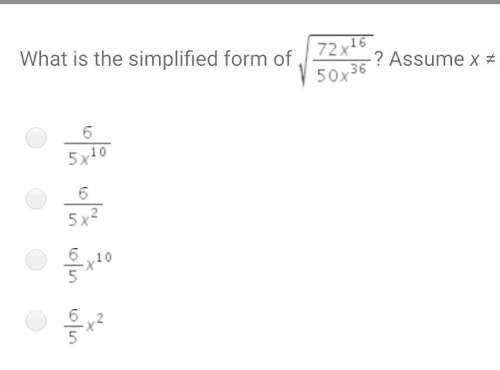

Mathematics, 10.10.2020 14:01

Mathematics, 10.10.2020 14:01

Mathematics, 10.10.2020 14:01

Advanced Placement (AP), 10.10.2020 14:01

Chemistry, 10.10.2020 14:01

History, 10.10.2020 14:01

Computers and Technology, 10.10.2020 14:01

Mathematics, 10.10.2020 14:01

Mathematics, 10.10.2020 14:01