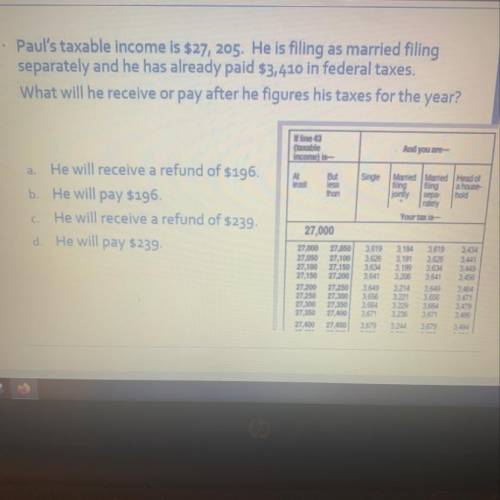

· Paul's taxable income is $27, 205. He is filing as married filing

separately and he has alre...

Mathematics, 11.04.2020 06:55 kimjooin02

· Paul's taxable income is $27, 205. He is filing as married filing

separately and he has already paid $3,410 in federal taxes.

What will he receive or pay after he figures his taxes for the year?

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 16:00

Explain step-by-step how to simplify -5(2x – 3y + 6z – 10).

Answers: 2

Mathematics, 22.06.2019 04:00

You are choosing between two health clubs. club a offers membership for a fee of $ 28 plus a monthly fee of $ 20. club b offers membership for a fee of $ 20 plus a monthly fee of $ 22. after how many months will the total cost of each health club be the same? what will be the total cost for each club? in __ months the total cost of each health club will be the same.

Answers: 1

Mathematics, 22.06.2019 05:30

When a number is decreased by 9.9% the result is 40. what is the original number to the nearest tenth? super urgent

Answers: 3

You know the right answer?

Questions

Chemistry, 31.07.2019 22:10

History, 31.07.2019 22:10

History, 31.07.2019 22:20