Mathematics, 22.04.2020 07:47 arichar

Ginny Jones receives $624 gross salary biweekly. Her income tax rate is 14%. Her group health plan contribution is $4.25 per pay period. She belongs to the company retirement plan, to which she contributes 6% of her earnings. She is also covered under Social Security benefits. Her current contribution is 6.05%.

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 14:00

Afunction is given: f(x)=3x+12 a. determine the inverse of this function and name it g(x) b. use composite functions to show that these functions are inverses. c. f(g(– explain: what is the domain?

Answers: 1

Mathematics, 21.06.2019 16:00

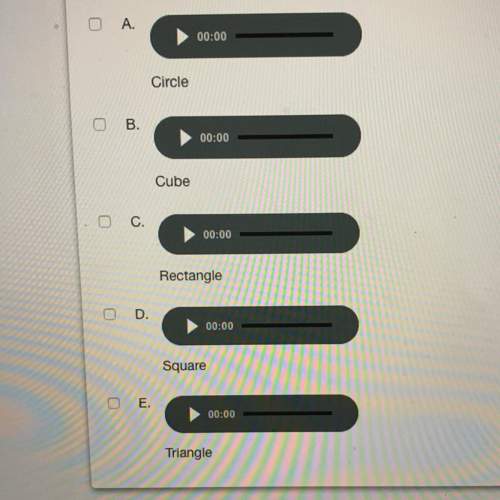

Which is the graph of the piecewise function f(x)? f(x)=[tex]f(x) = \left \{ {{-x+1, x\leq 0 } \atop {x+1, x\ \textgreater \ 0}} \right.[/tex]

Answers: 3

Mathematics, 21.06.2019 18:30

Suppose your school costs for this term were $4900 and financial aid covered 3/4 of that amount. how much did financial aid cover? and how much do you still have to pay?

Answers: 1

Mathematics, 21.06.2019 20:00

Sarah took the advertising department from her company on a round trip to meet with a potential client. including sarah a total of 11 people took the trip. she was able to purchase coach tickets for $280 and first class tickets for $1280. she used her total budget for airfare for the trip, which was $6080. how many first class tickets did she buy? how many coach tickets did she buy?

Answers: 1

You know the right answer?

Ginny Jones receives $624 gross salary biweekly. Her income tax rate is 14%. Her group health plan c...

Questions

Mathematics, 24.07.2019 22:00

Mathematics, 24.07.2019 22:00