Mathematics, 06.05.2020 06:10 mikeysoulemison

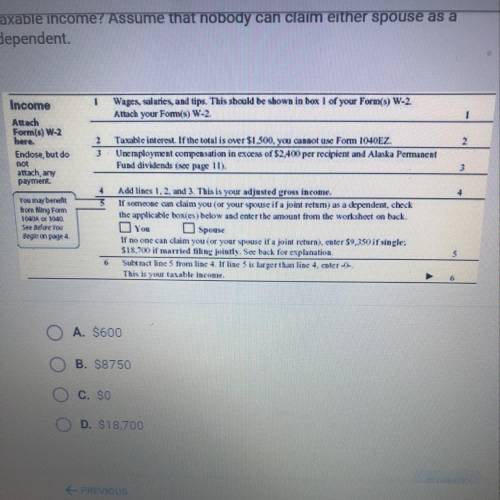

According to the Income section shown below from the 1040EZ form, if a married couple filing their federal income tax return jointly enters \$18,1 on line 4 for adjusted gross income, what would they enter on line 6 for their taxable income? Assume that nobody can claim either spouse as a dependent

A. 600

B. 8750

C. 0

D. 18,700

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 13:00

20 points! asap! a is known to be 6,500 feet above sea level; ab = 600 feet. the angle at a looking up at p is 20°. the angle at b looking up at p is 35°. how far above sea level is the peak p? find the height of the mountain peak to the nearest foot. height above sea level =

Answers: 1

Mathematics, 21.06.2019 14:30

After the seventh month of a 12-month loan: the numerator is: {(n + 11) + (n + 10) + (n + 9) + (n + 8) + (n + 7) + (n + 6) + (n + 5)} = , and the denominator is: {(n) + (n + 1) + + (n + 11)} = . therefore, the fraction is numerator/denominator (to the nearest tenth) = %

Answers: 2

Mathematics, 21.06.2019 20:50

In the diagram, gef and hef are congruent. what is the value of x

Answers: 1

You know the right answer?

According to the Income section shown below from the 1040EZ form, if a married couple filing their f...

Questions

Mathematics, 23.10.2019 21:00

English, 23.10.2019 21:00

Mathematics, 23.10.2019 21:00