Garth's taxable income last year was $97,450. According to the tax table

below, how much tax d...

Mathematics, 06.05.2020 04:31 reedj7736

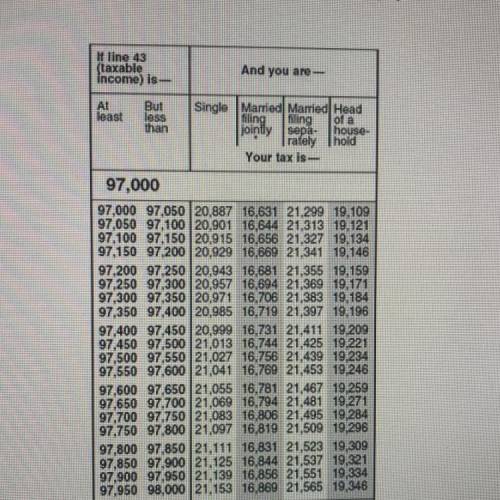

Garth's taxable income last year was $97,450. According to the tax table

below, how much tax does he have to pay if he files with the Single status?

A. $21,013

B. $16,731

C. $16,744

D. $20,999

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 20:30

Lola says these two expressions have the same value. expression a expression b which explains whether lola is correct?

Answers: 2

Mathematics, 21.06.2019 20:30

Stacey filled her 1/2 cup of measuring cup seven times to have enough flour for a cake recipe how much flour does the cake recipe calls for

Answers: 2

Mathematics, 21.06.2019 21:00

Rewrite the following quadratic functions in intercept or factored form. show your work. y = 5x^2 + 10x

Answers: 1

Mathematics, 21.06.2019 21:10

Which question is not a good survey question? a.don't you agree that the financial crisis is essentially over? 63on average, how many hours do you sleep per day? c. what is your opinion of educational funding this year? d.are you happy with the availability of electronic products in your state?

Answers: 2

You know the right answer?

Questions

Mathematics, 26.06.2020 23:01

Mathematics, 26.06.2020 23:01

Social Studies, 26.06.2020 23:01

Mathematics, 26.06.2020 23:01

Mathematics, 26.06.2020 23:01

Geography, 26.06.2020 23:01

Mathematics, 26.06.2020 23:01

Mathematics, 26.06.2020 23:01

Mathematics, 26.06.2020 23:01

Mathematics, 26.06.2020 23:01

Mathematics, 26.06.2020 23:01