Mathematics, 06.05.2020 01:17 silviamgarcia

Assume that expected return of the stock A in Rachel’s portfolio is 13.6% this year. The risk premium on the stocks of the same industry are 4.8%, betas of these stocks is 1.5 and the inflation rate was 2.7%. Calculate the risk-free rate of return using Capital Market Asset Pricing Model (CAPM).

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 16:20

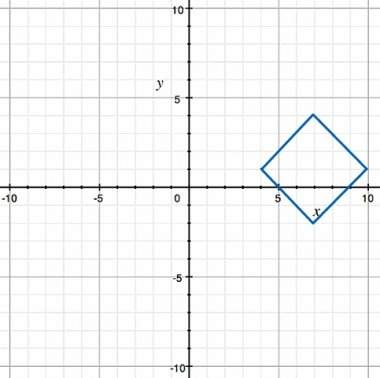

7.(03.01 lc)which set represents the range of the function shown? {(-1, 5), (2,8), (5, 3), 13, -4)} (5 points){-1, 2, 5, 13){(5, -1), (8, 2), (3,5), (-4, 13)){-4, 3, 5, 8}{-4, -1, 2, 3, 5, 5, 8, 13}

Answers: 3

Mathematics, 21.06.2019 17:00

Amanager recorded the number of bicycles sold by his company each quarter. his projected sales after t years is given by the expression below. which of the following statements best describes the expression? a. the initial sales of 575 bicycles increases at the rate of 4% over 4 quarters. b. the initial sales of 575 bicycles increases at the rate of 18% over 4 years. c. the initial sales of 575 bicycles increases at the rate of 4% over t quarters. d. the initial sales of 575 bicycles increases at the rate of 18% over t years.

Answers: 1

Mathematics, 21.06.2019 20:00

15m is what percent of 60m; 3m; 30m; 1.5 km? the last one is km not m

Answers: 1

Mathematics, 21.06.2019 20:40

David estimated he had about 20 fish in his pond. a year later, there were about 1.5 times as many fish. the year after that, the number of fish increased by a factor of 1.5 again. the number of fish is modeled by f(x)=20(1.5)^x. create a question you could ask that could be answered only by graphing or using a logarithm.

Answers: 1

You know the right answer?

Assume that expected return of the stock A in Rachel’s portfolio is 13.6% this year. The risk premiu...

Questions

Mathematics, 15.12.2020 20:30

Social Studies, 15.12.2020 20:30

Chemistry, 15.12.2020 20:30

Mathematics, 15.12.2020 20:30

Mathematics, 15.12.2020 20:30

Health, 15.12.2020 20:30

English, 15.12.2020 20:30

= 1.5

= 1.5