Mathematics, 05.05.2020 03:12 marvin07

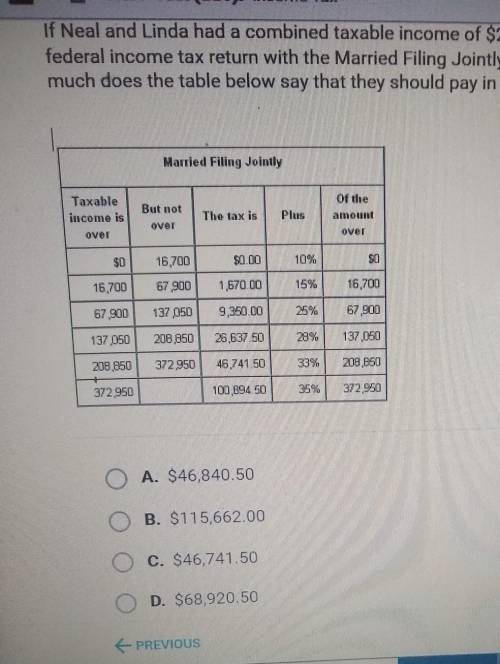

If Neal and Linda had a combined taxable income of $209,150 and filed their federal income tax with the married filing jointly status , how much does the table below say that they should pay in federal income tax?

Answers: 1

Another question on Mathematics

Mathematics, 20.06.2019 18:04

Carl wants to buy a television that cost $500 including taxes. to pay for television he will use a payment plan that requires him to make a down payment of $125 and then pay $70.50 each month for six months what is the percent increase from the original cast of the television to the cost of the television using a payment plan.

Answers: 1

Mathematics, 21.06.2019 23:30

In the diagram, ab is tangent to c, ab = 4 inches, and ad = 2 inches. find the radius of the circle.

Answers: 1

Mathematics, 22.06.2019 01:20

Ahyperbola centered at the origin has a vertex at (-6,0) and a focus at (10,0)

Answers: 2

You know the right answer?

If Neal and Linda had a combined taxable income of $209,150 and filed their federal income tax with...

Questions

Biology, 13.04.2021 22:30

Mathematics, 13.04.2021 22:30

Mathematics, 13.04.2021 22:30

Mathematics, 13.04.2021 22:30

Mathematics, 13.04.2021 22:30

Spanish, 13.04.2021 22:30

History, 13.04.2021 22:30

Mathematics, 13.04.2021 22:30