Mathematics, 03.06.2020 18:58 KallMeh

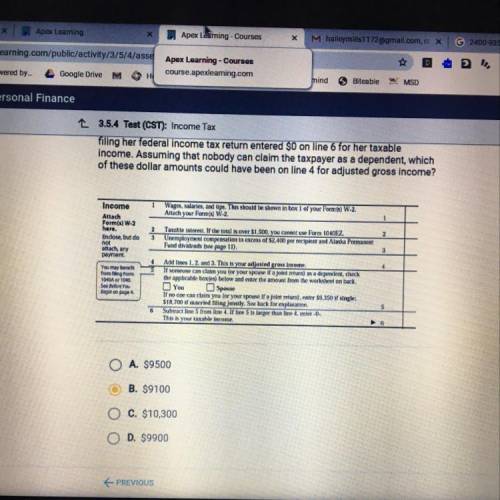

In the Income section shown below from the 1040EZ form, a single taxpayer

filing her federal income tax return entered $0 on line 6 for her taxable

income. Assuming that nobody can claim the taxpayer as a dependent, which

of these dollar amounts could have been on line 4 for adjusted gross income?

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 19:00

After t seconds, a ball tossed in the air from the ground level reaches a height of h feet given by the equation h = 144t-16t^2. after how many seconds will the ball hit the ground before rebounding?

Answers: 2

Mathematics, 21.06.2019 23:00

Jorge wants to determine the enlarged dimensions of a digital photo to be used as wallpaper on his computer screen. the original photo was 800 pixels wide by 600 pixels high. the new photo will be 1,260 pixels wide. what will the new height be?

Answers: 1

Mathematics, 21.06.2019 23:00

Janie has $3. she earns $1.20 for each chore she does and can do fractions of chores. she wants to earn enough money to buy a cd for $13.50.

Answers: 2

Mathematics, 21.06.2019 23:00

How many 3-digit numbers can you write using only digits 1 and 7? (of course, digits can repeat.) how many 3-digit numbers can you write using only digits 1 and 7? (of course, digits can repeat.)

Answers: 2

You know the right answer?

In the Income section shown below from the 1040EZ form, a single taxpayer

filing her federal income...

Questions

Mathematics, 07.01.2021 19:50

Mathematics, 07.01.2021 19:50

Mathematics, 07.01.2021 19:50

Mathematics, 07.01.2021 19:50

Health, 07.01.2021 19:50

Mathematics, 07.01.2021 19:50

SAT, 07.01.2021 19:50

Mathematics, 07.01.2021 19:50

English, 07.01.2021 19:50

World Languages, 07.01.2021 19:50

Arts, 07.01.2021 19:50

English, 07.01.2021 19:50