Mathematics, 09.06.2020 11:57 RandomLollipop

HELP

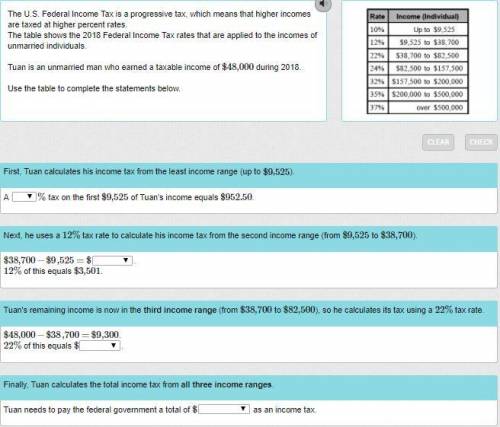

The U. S. Federal Income Tax is a progressive tax, which means that higher incomes are taxed at higher percent rates.

The table shows the 2018 Federal Income Tax rates that are applied to the incomes of unmarried individuals.

Tuan is an unmarried man who earned a taxable income of $48$48,000000 during 2018.

Use the table to complete the statements below.

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 20:00

Aquadratic equation in standard from is written ax^2= bx+c, where a,b and c are real numbers and a is not zero?

Answers: 1

Mathematics, 21.06.2019 20:20

Consider the following estimates from the early 2010s of shares of income to each group. country poorest 40% next 30% richest 30% bolivia 10 25 65 chile 10 20 70 uruguay 20 30 50 1.) using the 4-point curved line drawing tool, plot the lorenz curve for bolivia. properly label your curve. 2.) using the 4-point curved line drawing tool, plot the lorenz curve for uruguay. properly label your curve.

Answers: 2

Mathematics, 22.06.2019 00:30

Three friends are comparing the prices of various packages of golf balls at a sporting goods store. hector finds a package of 6 golf balls that costs $4.50.

Answers: 3

You know the right answer?

HELP

The U. S. Federal Income Tax is a progressive tax, which means that higher incomes are taxed a...

Questions

English, 18.03.2021 02:00

Chemistry, 18.03.2021 02:00

Mathematics, 18.03.2021 02:00

Mathematics, 18.03.2021 02:00

Business, 18.03.2021 02:00

English, 18.03.2021 02:00

Mathematics, 18.03.2021 02:00

Mathematics, 18.03.2021 02:00

Mathematics, 18.03.2021 02:00

Mathematics, 18.03.2021 02:00

Mathematics, 18.03.2021 02:00

Mathematics, 18.03.2021 02:00

Mathematics, 18.03.2021 02:00