Mathematics, 14.06.2020 01:57 KariSupreme

Suppose the following bond quotes for IOU Corporation appear in the financial page of today’s newspaper. Assume the bond has semiannual payments, a face value of $2,000 and the current date is April 19, 2018. Company (Ticker) Coupon Maturity Last Price Last Yield EST Vol (000s) 97 IOU (IOU) 7.45 Apr 19, 2034 Last price 92.945 a. What is the yield to maturity of the bond? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e. g., 32.16.) b. What is the current yield?

Answers: 1

Another question on Mathematics

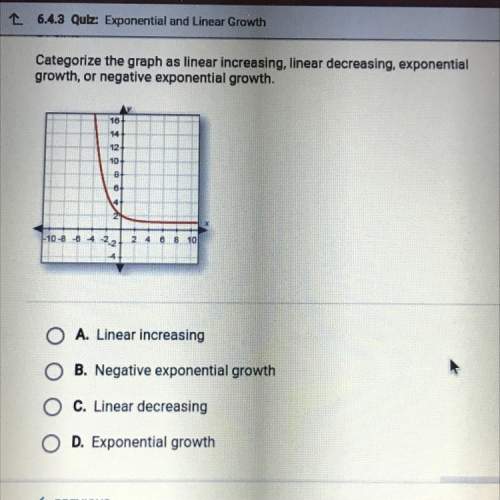

Mathematics, 21.06.2019 13:50

Question and answers are in the attached picture. you so much in advance.

Answers: 3

Mathematics, 21.06.2019 16:30

If your annual gross income is $62,000 and you have one monthly car payment of $335 and a monthly student loan payment of $225, what is the maximum house payment you can afford. consider a standard 28% front-end ratio and a 36% back-end ratio. also, to complete your calculation, the annual property tax will be $3,600 and the annual homeowner's premium will be $360.

Answers: 1

Mathematics, 21.06.2019 18:30

Factor k2 - 17k + 16. a.(k - 2)(k - 8) b.(k - 1)(k + 16) c.(k - 1)(k - 16)

Answers: 1

You know the right answer?

Suppose the following bond quotes for IOU Corporation appear in the financial page of today’s newspa...

Questions

History, 20.09.2020 14:01

English, 20.09.2020 14:01

English, 20.09.2020 14:01

Mathematics, 20.09.2020 14:01

History, 20.09.2020 14:01

History, 20.09.2020 14:01

English, 20.09.2020 14:01