Mathematics, 21.06.2020 16:57 marelinatalia2000

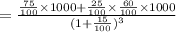

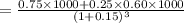

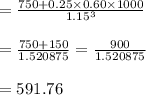

A corporate bond has a coupon rate of 5.5 percent, a $1,000 face value, and matures three years from today. The corporation is in a serious financial situation and has announced that no future annual interest payments will be paid and that the probability the entire face value will be repaid is only 75 percent. If the entire face value cannot be paid, then 60 percent of the face value will be repaid. All payments will be made three years from now. What is the current value of this bond at a discount rate of 15 percent?

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 18:00

Which shows the correct solution of the equation 1/2a+2/3b=50, when b=30?

Answers: 1

Mathematics, 21.06.2019 19:00

Write the pair of fractions as a pair of fractions with a common denominator

Answers: 3

Mathematics, 22.06.2019 02:20

Find the probability that -0.3203 < = z < = -0.0287 find the probability that -0.5156 < = z < = 1.4215 find the probability that 0.1269 < = z < = 0.6772

Answers: 2

You know the right answer?

A corporate bond has a coupon rate of 5.5 percent, a $1,000 face value, and matures three years from...

Questions

English, 18.12.2021 06:00

Chemistry, 18.12.2021 06:00

English, 18.12.2021 06:00

Mathematics, 18.12.2021 06:00

History, 18.12.2021 06:00

History, 18.12.2021 06:10

English, 18.12.2021 06:10

Chemistry, 18.12.2021 06:10