Mathematics, 03.07.2020 20:01 bellam302

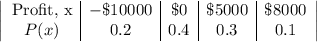

Claire is considering investing in a new business. In the first year, there is a probability of 0.2 that the new business will loose $10,000, a probability of 0.4 that the new business will break even ($0 loss or gain), a probability of 0.3 that the new business will make $5,000 in profits, and a probability of 0.1 that the new business will make $8,000 in profits.

A. Claire should invest in the company if she makes a profit. Should she invest? Explain using expected values.

B. If Claire’s initial investment is $1,200 and the expected value for the new business stays constant, how many years will it take for her to earn back her initial investment?

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 14:30

Geometry: determine whether segment mn is parallel to segment kl. justify your answer. jm 6 mk 3 jn 8 nl 4

Answers: 1

Mathematics, 21.06.2019 18:00

Agroup of students want to create a garden. they do not know the exact measurements but they propose using a variable to represent the length and width of the garden. the length of the garden is 10 feet longer than double the width. use a single variable to write algebraic expressions for both the length and width of the garden. write an algebraic expression for the area of the garden. use mathematical terms to describe this expression.

Answers: 3

Mathematics, 21.06.2019 19:30

[15 points]find the quotient with the restrictions. (x^2 - 2x - 3) (x^2 + 4x + 3) ÷ (x^2 + 2x - 8) (x^2 + 6x + 8)

Answers: 1

You know the right answer?

Claire is considering investing in a new business. In the first year, there is a probability of 0.2...

Questions

Mathematics, 07.02.2021 20:00

English, 07.02.2021 20:00

Biology, 07.02.2021 20:00

Mathematics, 07.02.2021 20:00

English, 07.02.2021 20:00

Mathematics, 07.02.2021 20:00

History, 07.02.2021 20:00