Mathematics, 04.09.2020 06:01 BeautyxQueen

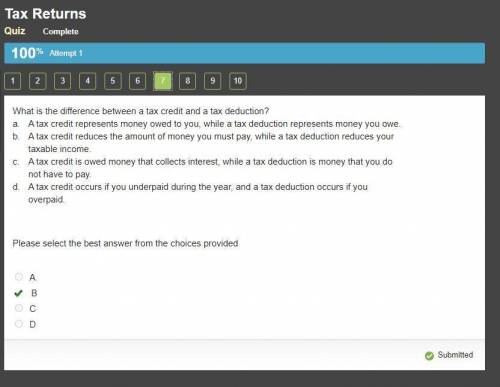

What is the difference between a tax credit and a tax deduction?

a. A tax credit represents money owed to you, while a tax deduction represents money you owe.

b. A tax credit reduces the amount of money you must pay, while a tax deduction reduces your taxable income.

c. A tax credit is owed money that collects interest, while a tax deduction is money that you do not have to pay.

d. A tax credit occurs if you underpaid during the year, and a tax deduction occurs if you overpaid.

It is B

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 18:00

Clara schumann is buying bagels for her coworkers, she buys a dozen bagels priced at $5.49 a dozen. the bakery's cost for making the bagels is $2.25 per dozen. what is the markup rate based on selling price on a dozen bagels?

Answers: 1

Mathematics, 21.06.2019 19:00

Acompany that manufactures and sells guitars made changes in their product range. from the start they had 20 models. then they reduced the number of models to 15. as a result, the company enjoyed a 10% increase in turnover. - how much did the stock level change? in (%)

Answers: 2

Mathematics, 21.06.2019 20:00

Given the graphed function below which of the following orders pairs are found on the inverse function

Answers: 1

Mathematics, 21.06.2019 20:30

Answer asap evaluate 4-0.25g+0.5h4−0.25g+0.5h when g=10g=10 and h=5h=5.

Answers: 3

You know the right answer?

What is the difference between a tax credit and a tax deduction?

a. A tax credit represents money o...

Questions

Biology, 28.08.2019 21:50

Mathematics, 28.08.2019 21:50

English, 28.08.2019 21:50

Mathematics, 28.08.2019 21:50

Social Studies, 28.08.2019 21:50

History, 28.08.2019 21:50

English, 28.08.2019 21:50

Biology, 28.08.2019 21:50

Social Studies, 28.08.2019 21:50

Computers and Technology, 28.08.2019 21:50

Social Studies, 28.08.2019 21:50

Physics, 28.08.2019 21:50

Mathematics, 28.08.2019 21:50

Geography, 28.08.2019 21:50

English, 28.08.2019 21:50

Mathematics, 28.08.2019 21:50