Mathematics, 05.09.2020 19:01 F00Dislife

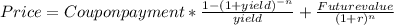

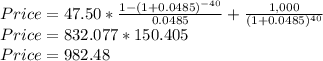

. Assume that you are considering the purchase of a 20-year, noncallable bond with an annual coupon rate of 9.5%. The bond has a face value of $1,000, and it makes semiannual interest payments. If you require an 10.7% nominal yield to maturity on this investment, what is the maximum price you should be willing to pay for the bond?

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 13:40

Use the distance formula to determine the distance that point q is from r on the hypotenusebased on a 2-3 ratio.i need asap !

Answers: 3

Mathematics, 21.06.2019 19:10

How many solutions does the nonlinear system of equations graphed below have?

Answers: 2

Mathematics, 21.06.2019 20:00

For what type of equity loan are you lent a lump sum, which is to be paid within a certain period of time? a. a line of credit b. equity c. a second mortgage d. an amortization

Answers: 3

Mathematics, 21.06.2019 21:00

M.xyz =radians. covert this radian measure to its equivalent measure in degrees.

Answers: 1

You know the right answer?

. Assume that you are considering the purchase of a 20-year, noncallable bond with an annual coupon...

Questions

English, 20.11.2020 21:50

History, 20.11.2020 21:50

English, 20.11.2020 21:50

Mathematics, 20.11.2020 21:50

Mathematics, 20.11.2020 21:50

History, 20.11.2020 21:50

Mathematics, 20.11.2020 21:50

Biology, 20.11.2020 21:50

English, 20.11.2020 21:50