Mathematics, 12.10.2020 22:01 leysirivera23ovez6n

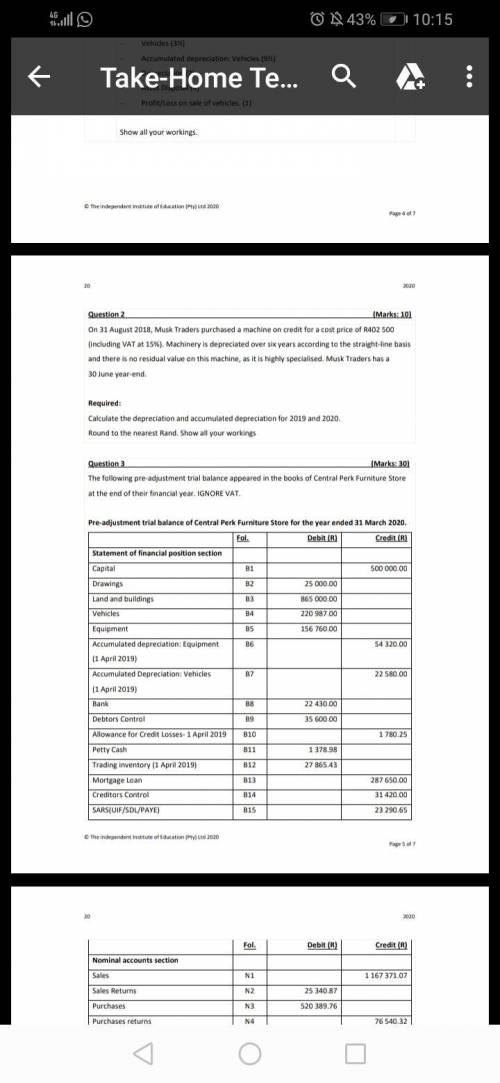

On 31st August 2018, Musk Traders purchased a machine on credit for a cost price of R402 500 (including VAt at 15 percent). Machinery is depreciated over six years according to the straight line basis and there is no residual value on this machine as it is highly specialised. Musk Traders has a 30 June year-end. Calculate the depreciation and accumulated depreciation for 2019 and 2020

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 15:30

Write the expression in simplified radical form. show all steps and work including any foil method work. (hint: use the conjugate. no decimal answers.) (9-2√3)/(12+√3)

Answers: 1

Mathematics, 21.06.2019 21:00

How many kilograms of a 5% salt solution and how many kilograms of a 15% salt solution must be mixed together to make 45kg of an 8% salt solution?

Answers: 3

Mathematics, 21.06.2019 23:00

Which graph represents the linear function below? y-3=1/2(x+2)

Answers: 2

You know the right answer?

On 31st August 2018, Musk Traders purchased a machine on credit for a cost price of R402 500 (includ...

Questions

History, 16.02.2021 05:00

Spanish, 16.02.2021 05:00

World Languages, 16.02.2021 05:00

Spanish, 16.02.2021 05:00

Mathematics, 16.02.2021 05:00

Mathematics, 16.02.2021 05:00

Spanish, 16.02.2021 05:00

English, 16.02.2021 05:00

Mathematics, 16.02.2021 05:00

Computers and Technology, 16.02.2021 05:00