Mathematics, 13.10.2020 14:01 payloo

Sally, an investor, purchases 3,000 shares in company X at $1.75 per share. After purchasing the shares the share price increases to $2.25 per share, after which Sally decides to sell her shares. Sally is required to pay 25% tax on all profits that she makes from the sale of the shares (called Capital Gains tax). Calculate the amount of tax that Sally must pay. Give your answer to the nearest dollar

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 18:00

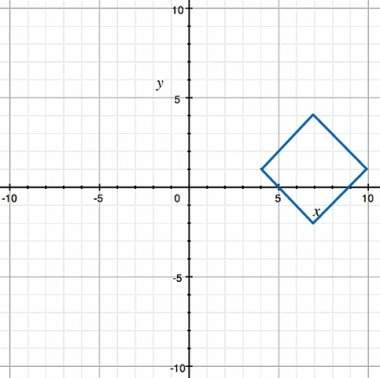

A. 90 degrees b. 45 degrees c. 30 degrees d. 120 degrees

Answers: 2

Mathematics, 21.06.2019 21:30

Acoffee shop orders at most $3,500 worth of coffee and tea. the shop needs to make a profit of at least $1,900 on the order. the possible combinations of coffee and tea for this order are given by this system of inequalities, where c = pounds of coffee and t = pounds of tea: 6c + 13t ≤ 3,500 3.50c + 4t ≥ 1,900 which graph's shaded region represents the possible combinations of coffee and tea for this order?

Answers: 1

Mathematics, 21.06.2019 22:00

Mrs. avila is buying a wallpaper border to go on all of her kitchen walls. she wants to buy 5 extra feet of wallpaper border than she needs to be sure she has enough. she buys 55.5 feet of the border. the store owner selling the border uses the width of mrs. avila's kitchen to determine that the length of her kitchen must be 14.5 feet.

Answers: 2

Mathematics, 22.06.2019 00:30

What is the perimeter of an isosceles triangle with each leg measuring 2x+3 and the base measuring 6x-2?

Answers: 1

You know the right answer?

Sally, an investor, purchases 3,000 shares in company X at $1.75 per share. After purchasing the sha...

Questions

Mathematics, 29.09.2021 22:40

Mathematics, 29.09.2021 22:40

Engineering, 29.09.2021 22:40

Geography, 29.09.2021 22:40

Social Studies, 29.09.2021 22:40

Mathematics, 29.09.2021 22:40

English, 29.09.2021 22:40