Mathematics, 16.10.2020 04:01 damien0lozano

6. Travis Jamison earns $42,500 annually as a new staff attorney.

He is single. The state tax rate in his state is 3.5% of taxable

income. What amount is withheld from his monthly pay for

state income tax?

7. Katie Haddad earns $394 per week. She is married and

claims 3 children as dependents. The state tax rate in Haddad's

state is 2% of taxable income. What amount is withheld from

her weekly pay for state income tax?

8. Antwan Campbell earns $494 per week. He is married and

claims 1 child as a dependent. The state tax rate is 2.25% of

taxable income. What amount is withheld from his weekly pay

for state income tax?

Plz help much needed

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 16:30

Beth makes batches of bluberry muffins and banna muffins. each batchis 6 muffins. she makes 2.5 batches of bluberry muffins. how many batches of bananna muffins should beth make if she wants to have a total of 60 muffins?

Answers: 1

Mathematics, 21.06.2019 18:50

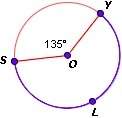

The trigonometric ratios sine and secant are reciprocals of each other

Answers: 2

Mathematics, 21.06.2019 23:30

Marking brainliest rewrite the equation x = 65 - 60p by factoring the side that contains the variable p.

Answers: 3

You know the right answer?

6. Travis Jamison earns $42,500 annually as a new staff attorney.

He is single. The state tax rate...

Questions

Social Studies, 24.12.2019 23:31

Mathematics, 24.12.2019 23:31

Mathematics, 24.12.2019 23:31

Physics, 24.12.2019 23:31

Chemistry, 24.12.2019 23:31