Mathematics, 19.10.2020 14:01 carethegymnast8954

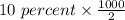

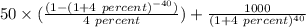

Cox Media Corporation pays a 10 percent coupon rate on debentures that are due in 20 years. The current yield to maturity on bonds of similar risk is 8 percent. The bonds are currently callable at $1,150. The theoretical value of the bonds will be equal to the present value of the expected cash flow from the bonds. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods.

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 19:00

The weekly revenue for a company is r = 3p^2 + 60p + 1060, where p is the price of the company's product. what price will result in a revenue of $1200.

Answers: 1

Mathematics, 21.06.2019 20:40

Lines a and b are parallel. what is the value of x? -5 -10 -35 -55

Answers: 2

Mathematics, 21.06.2019 22:20

Which strategy is used by public health to reduce the incidence of food poisoning?

Answers: 1

You know the right answer?

Cox Media Corporation pays a 10 percent coupon rate on debentures that are due in 20 years. The curr...

Questions

Social Studies, 18.08.2019 09:30

Geography, 18.08.2019 09:30

Mathematics, 18.08.2019 09:30

Biology, 18.08.2019 09:30

Social Studies, 18.08.2019 09:30

Chemistry, 18.08.2019 09:30

Mathematics, 18.08.2019 09:30

Mathematics, 18.08.2019 09:30

Mathematics, 18.08.2019 09:30

Geography, 18.08.2019 09:30

Mathematics, 18.08.2019 09:30

Biology, 18.08.2019 09:30

History, 18.08.2019 09:30

Biology, 18.08.2019 09:30

History, 18.08.2019 09:30