Mathematics, 21.10.2020 20:01 Ashley606hernandez

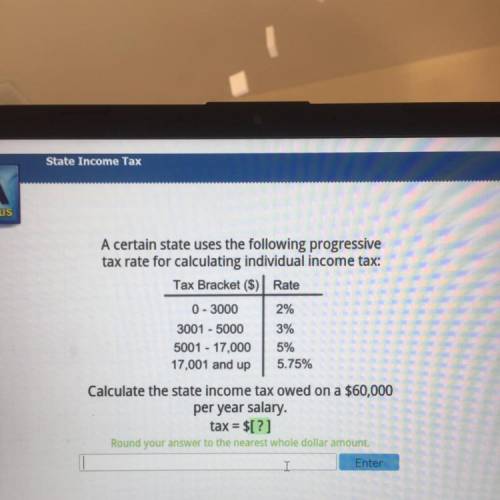

A certain state uses the following progressive

tax rate for calculating individual income tax:

Tax Bracket ($) Rate

0 - 3000 2%

3001 - 5000 3%

5001 - 17,000 5%

17,001 and up 5.75%

Calculate the state income tax owed on a $60,000

per year salary.

tax = $[?]

Round your answer to the nearest whole dollar amount.

Entor

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 18:50

The first few steps in solving the quadratic equation 9x2 + 49x = 22 ? 5x by completing the square are shown. 9x2 + 49x = 22 ? 5x 9x2 + 54x = 22 9(x2 + 6x) = 22 which is the best step to do next to solve the equation by completing the square? 9(x2 + 6x + 3) = 25 9(x2 + 6x + 3) = 49 9(x2 + 6x + 9) = 31 9(x2 + 6x + 9) = 103

Answers: 3

Mathematics, 21.06.2019 20:00

Adam used 1072.4 gallons of water over the course of 7 days. how much water did adam use, on average, each day?

Answers: 1

Mathematics, 22.06.2019 00:00

An equation in slope-intersept form the lines that passes thought (-8,1) and is perpindicular to the y=2x-17.

Answers: 1

Mathematics, 22.06.2019 00:00

Cd is the perpendicular bisector of both xy and st, and cy=20. find xy.

Answers: 1

You know the right answer?

A certain state uses the following progressive

tax rate for calculating individual income tax:

Questions

Spanish, 26.02.2021 08:30

Geography, 26.02.2021 08:30

Chemistry, 26.02.2021 08:30

Spanish, 26.02.2021 08:30

Mathematics, 26.02.2021 08:30

Mathematics, 26.02.2021 08:30

Mathematics, 26.02.2021 08:30

Mathematics, 26.02.2021 08:30

Mathematics, 26.02.2021 08:30

Chemistry, 26.02.2021 08:30

Physics, 26.02.2021 08:30

Geography, 26.02.2021 08:30