Mathematics, 27.10.2020 21:50 breebree6929

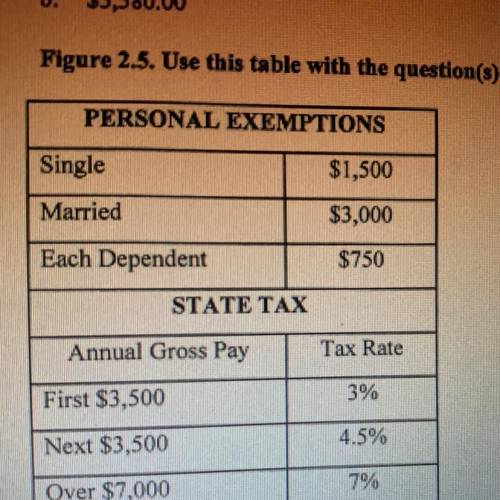

Darren Cooper's annual salary is $98,550. He takes a single exemption. Using the graduated income tax rates in Figure 2.5, find the annual state tax withheld.

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 14:30

Chandler was a caretaker at the state zoo. he noticed that the number of animals adopted by the zoo increased at a constant rate every year since 2010. which of the following graphs shows the slowest rate at which the animals in the zoo were adopted?

Answers: 2

Mathematics, 21.06.2019 23:00

What is the sum of the first 8 terms of the geometric series

Answers: 3

Mathematics, 21.06.2019 23:30

Atruck can be rented from company a $50 a day plus $0.60 per mile. company b charges $20 a day plus $0.80 per mile to rent the same truck. find the number of miles in a day at which the rental costs for company a and company b are the same

Answers: 1

Mathematics, 22.06.2019 01:30

Robert is placing sod in two square shaped areas of his backyard. one side of the first area is 7.5 feet. one side of the other area is 5.7 feet. the sod costs y dollars per square foot

Answers: 3

You know the right answer?

Darren Cooper's annual salary is $98,550. He takes a single exemption. Using the graduated income ta...

Questions

Mathematics, 18.10.2020 16:01

Mathematics, 18.10.2020 16:01

History, 18.10.2020 16:01

Chemistry, 18.10.2020 16:01

Mathematics, 18.10.2020 16:01

Mathematics, 18.10.2020 16:01

Chemistry, 18.10.2020 16:01

Mathematics, 18.10.2020 16:01

Mathematics, 18.10.2020 16:01

Chemistry, 18.10.2020 16:01

French, 18.10.2020 16:01