Mathematics, 30.10.2020 20:50 jonmorton159

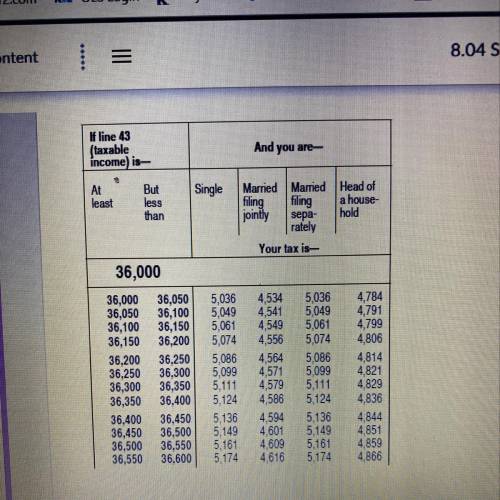

David's taxable income is $36,480. He is filing as married filing jointly, and he has already paid $4047 in federal taxes. What will he receive or pay after he figures his taxes for the year?

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 16:00

Elena and her husband marc both drive to work. elena's car has a current mileage (total distance driven) of 15,000 and she drives 23,000 miles more each year. marc's car has a current mileage of 46,000 and he drives 9,000 miles more each year. will the mileages for the two cars ever be equal? explain.

Answers: 2

Mathematics, 21.06.2019 19:30

Solve the following inequalities and show the solution on a number line. 2x+3< 3(4x+5)

Answers: 1

Mathematics, 21.06.2019 20:00

Formulate alisha has a number in mind. if she adds three to her number the result is less than five. use this information to write and solve an inequality about alisha's number. then graph the solution set.

Answers: 1

You know the right answer?

David's taxable income is $36,480. He is filing as married filing jointly, and he has already paid $...

Questions

Mathematics, 25.08.2021 22:30

Chemistry, 25.08.2021 22:30

Mathematics, 25.08.2021 22:30

World Languages, 25.08.2021 22:30

Mathematics, 25.08.2021 22:40

Mathematics, 25.08.2021 22:40

Mathematics, 25.08.2021 22:40

Chemistry, 25.08.2021 22:40

Law, 25.08.2021 22:40