Mathematics, 08.12.2020 16:50 coolgirl10020031

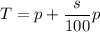

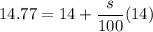

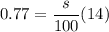

When you buy an item on which sales tax is charged, the total cost is calculated by the formula T=P+s/100p where T is the total cost, p is the items price, and s is the sales tax rate (as a percent). If you pay $14.77 for an item priced at $14, what was the tax rate ?

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 16:50

The vertices of a triangle are a(7,5), b(4,2), c(9,2). what is m

Answers: 2

Mathematics, 21.06.2019 20:00

Find the value of x. give reasons to justify your solutions! l, m ∈ kn

Answers: 3

Mathematics, 22.06.2019 03:30

Find the simplified product: 2sqrt 5x^3(-3sqrt10x^2) a: -30sqrt2x^5 b: -30x^2sqrt2x c: -12x^2sqrt5x d: -6sqrt50x^5

Answers: 2

You know the right answer?

When you buy an item on which sales tax is charged, the total cost is calculated by the formula T=P+...

Questions

Mathematics, 10.09.2020 21:01

Mathematics, 10.09.2020 21:01

History, 10.09.2020 21:01

Mathematics, 10.09.2020 21:01

Mathematics, 10.09.2020 21:01

Mathematics, 10.09.2020 21:01

Mathematics, 10.09.2020 21:01

Mathematics, 10.09.2020 21:01

Mathematics, 10.09.2020 21:01

Mathematics, 10.09.2020 21:01

English, 10.09.2020 21:01

Computers and Technology, 10.09.2020 21:01

Mathematics, 10.09.2020 21:01

Mathematics, 10.09.2020 21:01

Mathematics, 10.09.2020 21:01

Mathematics, 10.09.2020 21:01

Mathematics, 10.09.2020 21:01

Mathematics, 10.09.2020 21:01

Mathematics, 10.09.2020 21:01

Mathematics, 10.09.2020 21:01