Mathematics, 15.01.2021 05:30 vanessa23272

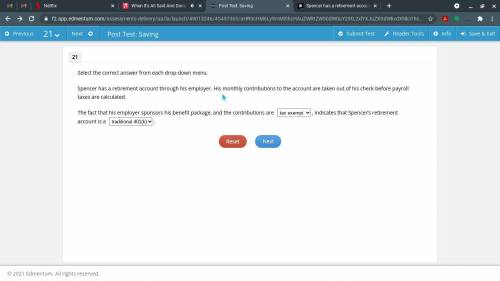

Spencer has a retirement account through his employer. His monthly contributions to the account are taken out of his check before payroll

taxes are calculated.

The fact that his employer sponsors his benefit package, and the contributions are

account is a

indicates that Spencer's retirement account is a

1.tax exempt

Tax deferred

2.traditional ira

Roth ira

Traditional 401(k)

Roth 401(k)

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 20:30

Linda loans her friend $250 with a 5% monthly intrest rate. how much was the whole loan?

Answers: 1

Mathematics, 21.06.2019 21:20

An office supply company conducted a survey before marketing a new paper shredder designed for home use. in the survey, 80 % of the people who tried the shredder were satisfied with it. because of this high satisfaction rate, the company decided to market the new shredder. assume that 80 % of all people are satisfied with this shredder. during a certain month, 100 customers bought this shredder. find the probability that of these 100 customers, the number who are satisfied is 69 or fewer.

Answers: 2

Mathematics, 21.06.2019 23:00

Complete the conditional statement. if a + 2 < b + 3, then a < b b < a a – b < 1 a < b + 1

Answers: 3

You know the right answer?

Spencer has a retirement account through his employer. His monthly contributions to the account are...

Questions

Mathematics, 01.09.2019 22:10

Mathematics, 01.09.2019 22:10

Biology, 01.09.2019 22:10

Mathematics, 01.09.2019 22:10

Mathematics, 01.09.2019 22:10

Business, 01.09.2019 22:10

Mathematics, 01.09.2019 22:10

History, 01.09.2019 22:10