Mathematics, 04.03.2021 14:30 taylorwhitfield6

21. एकजना डिलरले 13% भ्याट बाहेक रु. 1,50,000 पर्ने एउटा

मेसिन एकजना खुद्रा पसलेलाई बिक्री गयो । खुद्रा पसलेले सो

मेसिन रु. 400 ढुवानी भाडा, रु. 1500 स्थानीय कर र रु. 700

नाफा राखेर ग्राहकलाई बेच्यो। ग्राहकले कति भ्याट रकम तिरेको

थियो ? यसको भ्याट सहितको अन्तिम मूल्य पत्ता लगाउनुहोस् ।

A dealer sold a machine worth Rs 1,50,000 excluding

13% VAT to a retailer suppliers. The retailer sold the

machine including Rs 400 transportation fair, Rs

1500 local tax and Rs 700 profit to the customer.

What amount should the customer had paid as VAT?

Also find its final price with VAT.

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 18:30

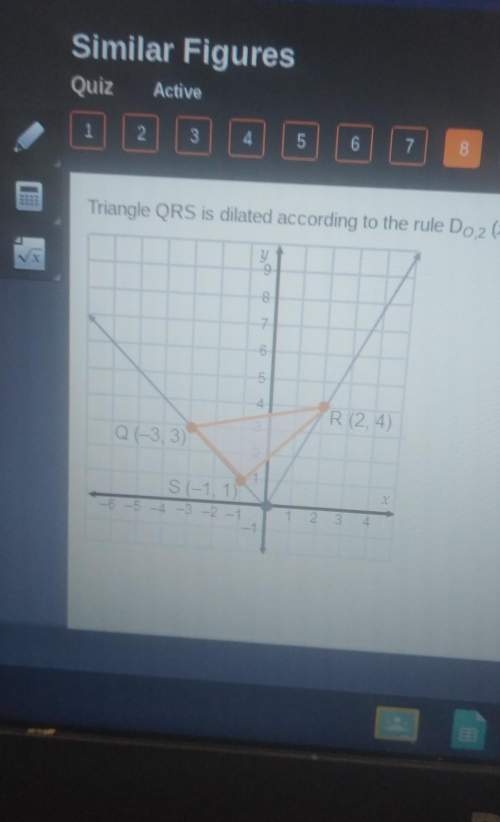

In the triangles, tr = ge and sr = fe. if = 3.2 ft, which is a possible measure of ? 1.6 ft 3.0 ft 3.2 ft 4.0 ft

Answers: 2

Mathematics, 21.06.2019 19:10

Asystem of equations has 1 solution.if 4x-y=5 is one of the equations , which could be the other equation ?

Answers: 1

Mathematics, 21.06.2019 22:20

Atriangle has verticals at b(-3,0), c(2,-1), d(-1,2). which transformation would produce an image with verticals b”(-2,1), c”(3,2), d”(0,-1)?

Answers: 2

Mathematics, 22.06.2019 00:00

Alice is paying her bill at a restaurant. but tax on the cost of a male is 5%. she decides to leave a tip 20% of the cost of the meal plus the tax

Answers: 3

You know the right answer?

21. एकजना डिलरले 13% भ्याट बाहेक रु. 1,50,000 पर्ने एउटा

मेसिन एकजना खुद्रा पसलेलाई बिक्री गयो । खु...

Questions

Mathematics, 05.04.2021 05:20

Mathematics, 05.04.2021 05:20

Mathematics, 05.04.2021 05:20

Biology, 05.04.2021 05:20

Social Studies, 05.04.2021 05:20

Mathematics, 05.04.2021 05:20

Physics, 05.04.2021 05:20

Spanish, 05.04.2021 05:20