Mathematics, 05.03.2021 01:10 Savy8595

Marilyn has a biweekly gross pay of $810 and claims 3 federal withholding allowances. Marilyn has all of the following deductions from her gross pay:

Social Security tax that is 6.2% of her gross pay

Medicare tax that is 1.45% of her gross pay

state tax that is 21% of her federal tax

Determine how Marilyn’s net pay will be affected if she increases her federal withholding allowances from 3 to 4.

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 16:30

If your annual gross income is $62,000 and you have one monthly car payment of $335 and a monthly student loan payment of $225, what is the maximum house payment you can afford. consider a standard 28% front-end ratio and a 36% back-end ratio. also, to complete your calculation, the annual property tax will be $3,600 and the annual homeowner's premium will be $360.

Answers: 1

Mathematics, 21.06.2019 17:30

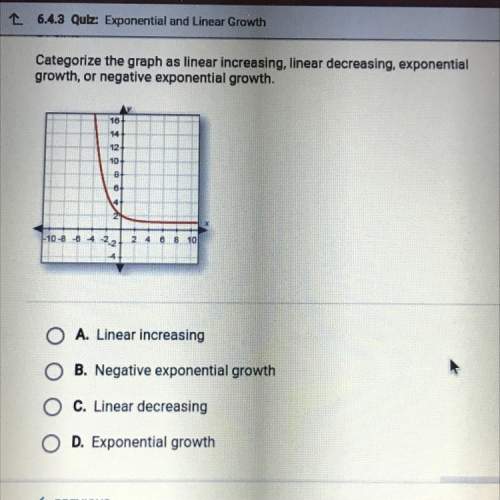

Which of the following is true about the graph of f(x)=7^x. select all that apply. a= it intercepts the x axis b=it intercepts both axis c=it intercepts neither d=it intercepts the y axis

Answers: 1

Mathematics, 21.06.2019 20:50

Including 6% sales tax, an inn charges $135.68 per night. find the inns nightly cost

Answers: 1

You know the right answer?

Marilyn has a biweekly gross pay of $810 and claims 3 federal withholding allowances. Marilyn has al...

Questions

Mathematics, 11.12.2020 04:10

English, 11.12.2020 04:10

Mathematics, 11.12.2020 04:10

Geography, 11.12.2020 04:10

Advanced Placement (AP), 11.12.2020 04:10

History, 11.12.2020 04:10

Mathematics, 11.12.2020 04:10

Mathematics, 11.12.2020 04:10

Health, 11.12.2020 04:10

Mathematics, 11.12.2020 04:10