Mathematics, 10.03.2021 22:50 zodiacpumpkin1126

Suppose a $ 50 per unit tax on gasoline is place on the seller and

assume that the demand curve for gasoline is perfectly inelastic

and the supply curve is elastic. Assume that the equilibrium price

on gasoline is $100 and the equilibrium quantity of oil before the

I

tax is implemented is 150,000 units. Please answer the following

questions using a supply and demand graph and words.

a. As a result of the $50 per unit tax on gasoline being placed on

the sellers, did the supply curve shift to the left or to the right?

What happened to the equilibrium price and equilibrium

quantity of oil after the $50 per unit tax was implemented? Who

pays most or all of the burden of the $50 tax, the buyer or the

seller, and WHY?

b. Please calculate the tax revenue collected by the government.

Please show your work and calculation.

c. Did the government make the right decision in implementing

the $50 per unit tax on the sellers? Why or why not? Explain.

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 14:50

Statement: if two points are given, then exactly one line can be drawn through those two points. which geometry term does the statement represent? defined term postulate theorem undefined term

Answers: 1

Mathematics, 21.06.2019 16:30

What could explain what happened when the time was equal to 120 minutes

Answers: 2

Mathematics, 21.06.2019 16:30

Find the greatest common factor of -30x 4 yz 3 and 75x 4 z 2.

Answers: 1

Mathematics, 21.06.2019 18:00

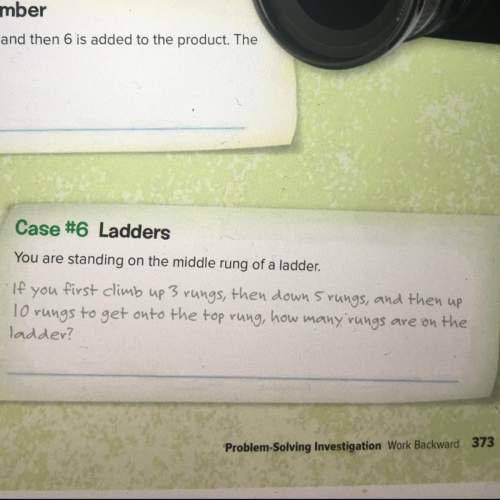

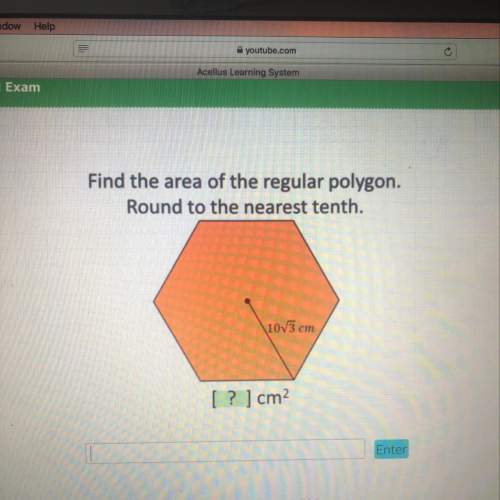

Need on this geometry question. explain how you did it.

Answers: 1

You know the right answer?

Suppose a $ 50 per unit tax on gasoline is place on the seller and

assume that the demand curve for...

Questions

Mathematics, 17.10.2020 07:01

Mathematics, 17.10.2020 07:01

Mathematics, 17.10.2020 07:01

Chemistry, 17.10.2020 07:01

Social Studies, 17.10.2020 07:01

Physics, 17.10.2020 07:01

Mathematics, 17.10.2020 07:01

World Languages, 17.10.2020 07:01

Mathematics, 17.10.2020 07:01

Social Studies, 17.10.2020 07:01

Mathematics, 17.10.2020 07:01

World Languages, 17.10.2020 07:01

Arts, 17.10.2020 07:01

English, 17.10.2020 07:01