Mathematics, 11.03.2021 01:00 Hammon1774

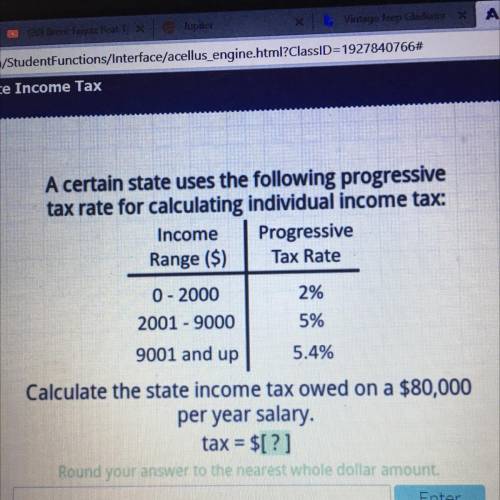

A certain state uses the following progressive

tax rate for calculating individual income tax:

Income Progressive

Range ($) Tax Rate

0 - 2000

2%

2001 - 9000 5%

9001 and up

5.4%

Calculate the state income tax owed on a $80,000

per year salary.

tax = $[?]

Round your answer to the nearest whole dollar amount.

Answers: 1

Another question on Mathematics

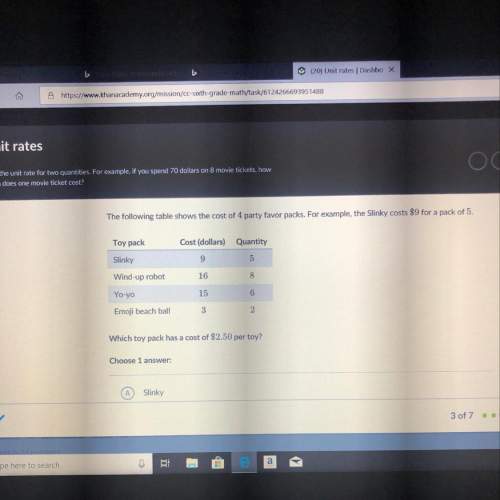

Mathematics, 21.06.2019 16:50

The rate of decay of a radioactive substance depends upon the amount present initially. the mass y (mg) of the radioactive substance cobalt-60 present in a sample at time t (years) is represented by the exponential equation y=50e −0.1315 t . answer the following questions in complete sentences. 1. how does the exponential equation above compare to the equation for simple interest that is compounded continuously? explain the similarities. 2. what is the initial amount of cobalt-60 in the sample? 2. how much cobalt-60 is left after 8.4 years? show your work. 3. what would be the y-intercept of the graph? what does it represent? 4. after how many years will the amount of cobalt-60 left be 6.25 mg? explain what happens to the cobalt-60 after 50 years? 5. discuss some “real-world” examples and uses of cobalt-60

Answers: 1

Mathematics, 22.06.2019 01:30

Problem number 26 of the rhind papyrus says: find a quantity such that when it is added to of itself the result is a 15. the modern day equation that models this problem is x + x = 15. what is the solution to the equation? x = 10 x = 12 x = 15 x = 30

Answers: 1

You know the right answer?

A certain state uses the following progressive

tax rate for calculating individual income tax:

Questions

Biology, 27.05.2021 14:00

Mathematics, 27.05.2021 14:00

Law, 27.05.2021 14:00

Social Studies, 27.05.2021 14:00

English, 27.05.2021 14:00

Computers and Technology, 27.05.2021 14:00

Mathematics, 27.05.2021 14:00

French, 27.05.2021 14:00

Mathematics, 27.05.2021 14:00

Biology, 27.05.2021 14:00