Mathematics, 19.03.2021 06:20 ueuwuwj

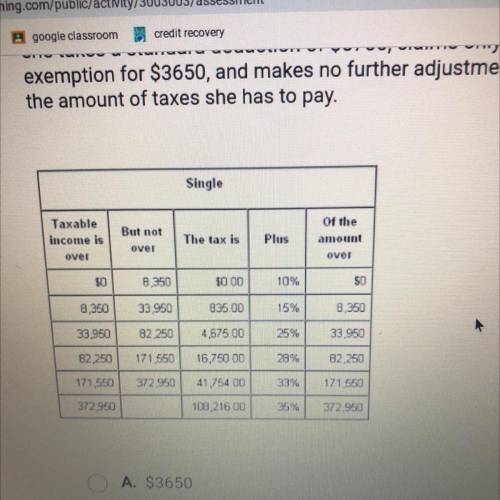

A nutritionist filling her federal income tax retum with the Single filing status

had a gross income of $34,200. She made a $1000 contribution to an IRA. If

she takes a standard deduction of $5700, claims only herself as an

exemption for $3650, and makes no further adjustment to her income, find

the amount of taxes she has to pay.

A. S3650

B. $2560

C. $8400

D. S3160

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 15:00

Brady has a 20 year fixed rate mortgage for $215,500 with monthly payments of 1,305.89.the annual interest rate is 4%. what is the total cost of the principal and interest for this loan rounded to the nearest dollar

Answers: 3

Mathematics, 21.06.2019 18:00

1. a parachutist is 800 feet above the ground when she opens her parachute. she then falls at a constant rate of 5 feet per second. select the equation that represents this situation. h = -800t + 5 y = -5x + 800 h = 5t - 800 y = 800x + 5 i need

Answers: 1

Mathematics, 21.06.2019 19:30

Okay so i didn't get this problem petro bought 8 tickets to a basketball game he paid a total of $200 write an equation to determine whether each ticket cost $26 or $28 so i didn't get this question so yeahyou have a good day.

Answers: 1

Mathematics, 22.06.2019 00:20

What is the slope of the line passing through the points (3, 3) and (5, 7) ? 1. 2 2. 1/2 3. −2 4. −1/2

Answers: 2

You know the right answer?

A nutritionist filling her federal income tax retum with the Single filing status

had a gross incom...

Questions

Mathematics, 01.12.2021 04:10

SAT, 01.12.2021 04:10

Physics, 01.12.2021 04:10

History, 01.12.2021 04:10

Chemistry, 01.12.2021 04:10

Mathematics, 01.12.2021 04:10

Arts, 01.12.2021 04:10

Mathematics, 01.12.2021 04:10

Chemistry, 01.12.2021 04:10

Biology, 01.12.2021 04:10