Mathematics, 19.03.2021 20:20 jaidyn3mccoy6

4. Michael makes an annual gross salary of $68,950. The state tax on the first $6,000 of his

income is 3% and 5% for amounts over $6,000. Find the total amount of graduated state

income tax withheld annually from Michael's annual salary. (No allowances in this

problem).

pls help me and i need to show work :((

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 20:00

You wanted to draw an enlargement of design that printed on a card that is 4 in by 5

Answers: 1

Mathematics, 21.06.2019 21:30

50 people men and women were asked if they watched at least one sport on tv. 20 of the people surveyed are women, but only 9 of them watch at least one sport on tv. 16 of the men watch at least one sport on tv. make a a two-way table and a relative frequency table to represent the data.

Answers: 3

Mathematics, 21.06.2019 23:00

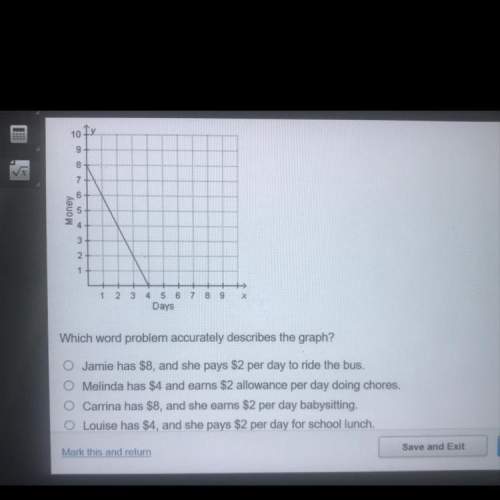

Which of the following graphs could represent a cubic function?

Answers: 1

Mathematics, 22.06.2019 00:00

Can someone me with this? i’m not sure what to put for my equations.

Answers: 2

You know the right answer?

4. Michael makes an annual gross salary of $68,950. The state tax on the first $6,000 of his

income...

Questions

Physics, 13.11.2020 20:30

Chemistry, 13.11.2020 20:30

Mathematics, 13.11.2020 20:30

Mathematics, 13.11.2020 20:30

Physics, 13.11.2020 20:30

English, 13.11.2020 20:30

Mathematics, 13.11.2020 20:30