Mathematics, 28.08.2019 04:30 Juliianatafur22

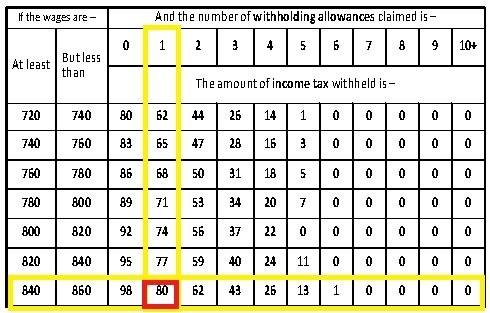

Selina claims single having one exemption. her state tax deduction is 21% of her federal tax contribution. calculate the amount of state tax selina owes if her gross pay for two weeks is $840. the following federal tax table is for biweekly earnings of a single person.

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 20:30

Barbara has a good credit history and is able to purchase a car with a low-interest car loan. she co-signs a car loan for her friend jen, who has poor credit history. then, jen defaults on the loan. who will be held legally responsible by the finance company and why? select the best answer from the choices provided. a. barbara will be held legally responsible because she has a good credit history. b. jen will be held legally responsible because she drives the car. c. barbara will be held legally responsible because she is the co-signer. d. jen will be held legally responsible because she has a poor credit history. the answer is a

Answers: 3

Mathematics, 22.06.2019 00:00

One positive integer is 2 less than another. the product of the two integers is 24. what are the integers?

Answers: 1

Mathematics, 22.06.2019 02:20

Which equation can be simplified to find the inverse of y = 2x2^2

Answers: 2

Mathematics, 22.06.2019 02:20

The function p(x) = –2(x – 9)2 + 100 is used to determine the profit on t-shirts sold for x dollars. what would the profit from sales be if the price of the t-shirts were $15 apiece?

Answers: 2

You know the right answer?

Selina claims single having one exemption. her state tax deduction is 21% of her federal tax contrib...

Questions

History, 04.06.2020 13:19

Mathematics, 04.06.2020 13:19

Mathematics, 04.06.2020 13:19

English, 04.06.2020 13:19

History, 04.06.2020 13:19