Mathematics, 07.04.2021 18:00 bettybales1986

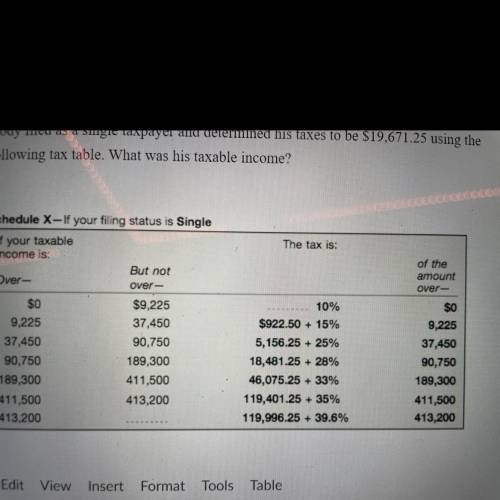

Cody filed as a single taxpayer and determined his taxes to be $19,671.25 using the following tax table. What was his taxable income?

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 15:10

Fractions can be added and subtracted only if they're fractions. a. like b. proper c. improper d. unlike

Answers: 1

Mathematics, 21.06.2019 17:00

Ifurniture stores having a weekend sale and is offering 20% discount on patio chairs and table the sales tax on furniture is 6.25 using function composition how can you represent the total amount a that you would need to pay for this furniture that cost x dollars

Answers: 1

Mathematics, 21.06.2019 17:30

Cora bought a package of erasers. there are 4 pink erasers and 12 blue erasers. what is the ratio of pink erasers to blue erasers?

Answers: 2

Mathematics, 21.06.2019 21:50

Scores on a university exam are normally distributed with a mean of 78 and a standard deviation of 8. the professor teaching the class declares that a score of 70 or higher is required for a grade of at least “c.” using the 68-95-99.7 rule, what percentage of students failed to earn a grade of at least “c”?

Answers: 1

You know the right answer?

Cody filed as a single taxpayer and determined his taxes to be $19,671.25 using the

following tax t...

Questions

Mathematics, 08.12.2020 01:00

Biology, 08.12.2020 01:00

Mathematics, 08.12.2020 01:00

Biology, 08.12.2020 01:00

English, 08.12.2020 01:00

Mathematics, 08.12.2020 01:00

Computers and Technology, 08.12.2020 01:00

Geography, 08.12.2020 01:00