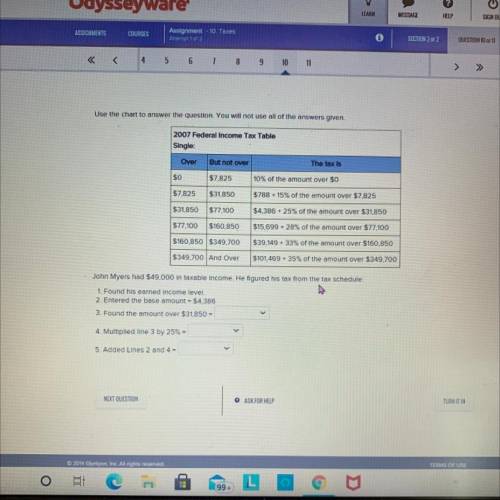

2007 Federal Income Tax Table

Single:

Over

But not over

The tax is

$0

...

Mathematics, 07.04.2021 22:20 nurikchan

2007 Federal Income Tax Table

Single:

Over

But not over

The tax is

$0

$7.825

10% of the amount over $0

$7.825

$31.850

$788 + 15% of the amount over $7,825

$31,850

$77.100

$4,386 + 25% of the amount over $31.850

$77.100

$160.850

$15,699 + 28% of the amount over $77.100

$160.850 $349.700

$39.149 + 33% of the amount over $160,850

$349.700 And Over

$101.469 + 35% of the amount over $349.700

John Myers had $49.000 in taxable income. He figured his tax from the tax schedule:

1. Found his earned Income level.

2. Entered the base amount = $4.386

3. Found the amount over $31.850 =

4. Multiplied line 3 by 25% =

5. Added Lines 2 and 4 =

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 14:40

What signals you that factoring by grouping is the best method to use when factoring a problem?

Answers: 2

Mathematics, 21.06.2019 16:00

What is the value of x? enter your answer in the box. x = two intersecting tangents that form an angle of x degrees and an angle of 134 degrees.

Answers: 3

Mathematics, 21.06.2019 17:00

Consider the function represented by the equation 1/2 j + 1/4 k equals 3 which shows the equation written in function notation with j as the independent variable

Answers: 1

Mathematics, 21.06.2019 19:20

Brainliest ! which of the coordinates are not of th vertices of the feasible region for the system of inequalities y≤4,,x≤5,x+y> 6 a(2,4) b(0,6) c(5,4) d(5,1)

Answers: 2

You know the right answer?

Questions

Computers and Technology, 13.10.2020 14:01

English, 13.10.2020 14:01

Mathematics, 13.10.2020 14:01

Mathematics, 13.10.2020 14:01

Mathematics, 13.10.2020 14:01

Mathematics, 13.10.2020 14:01

Mathematics, 13.10.2020 14:01

Mathematics, 13.10.2020 14:01

Spanish, 13.10.2020 14:01

Physics, 13.10.2020 14:01

English, 13.10.2020 14:01