Mathematics, 26.08.2019 23:00 evazquez

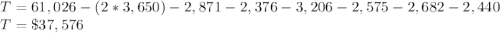

Say you are filing as a single taxpayer. you have a gross income of $61,026 and claim two exemptions. you can make a deduction of $2,871 for interest on your mortgage, a deduction of $2,376 for property tax, an adjustment of $3,206 for business losses, an adjustment of $2,575 for contributions to your retirement plan, a deduction of $2,682 for medical expenses, and an adjustment of $2,440 for business expenses. if exemptions are each worth $3,650 and the standard deduction is $5,700, what is your total taxable income?

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 22:30

How can you find the mean absolute deviation (mad) for this set of data?

Answers: 3

Mathematics, 21.06.2019 23:20

Find the common ratio of the sequence. -4, 8, -16, 32, a: -12b: -2c: 12d: -1/-2

Answers: 1

Mathematics, 22.06.2019 00:00

The construction of copying qpr is started below. the next step is to set the width of the compass to the length of ab. how does this step ensure that a new angle will be congruent to the original angle?

Answers: 1

You know the right answer?

Say you are filing as a single taxpayer. you have a gross income of $61,026 and claim two exemptions...

Questions

Mathematics, 08.10.2021 15:40

Mathematics, 08.10.2021 15:40

Mathematics, 08.10.2021 15:40

Mathematics, 08.10.2021 15:40

Business, 08.10.2021 15:50

Mathematics, 08.10.2021 15:50

Mathematics, 08.10.2021 15:50

English, 08.10.2021 15:50

Mathematics, 08.10.2021 15:50